Growing Awareness of Food Safety

The Sulfure Dioxide Market is benefiting from the growing awareness of food safety and quality among consumers. Sulfure dioxide is widely recognized for its role as a preservative in various food products, particularly dried fruits and vegetables. As consumers become more health-conscious, the demand for safe and preserved food items is on the rise. Recent statistics indicate that The Sulfure Dioxide is projected to grow at a rate of approximately 4% annually, which is likely to drive the consumption of sulfure dioxide as a key ingredient. Furthermore, regulatory bodies are increasingly emphasizing the importance of food safety standards, which may further propel the use of sulfure dioxide in food preservation. This trend underscores the critical role of sulfure dioxide in ensuring food quality and safety within the Sulfure Dioxide Market.

Rising Demand in Wine Production

The Sulfure Dioxide Market is significantly influenced by the increasing demand for wine production, where sulfure dioxide serves as a crucial preservative. It is widely used to prevent oxidation and maintain the quality of wine, ensuring its longevity and flavor integrity. Recent data suggests that The Sulfure Dioxide is projected to reach a value of over 400 billion USD by 2025, with a steady growth rate of around 5% annually. This trend indicates a corresponding rise in the consumption of sulfure dioxide, as winemakers seek to enhance the quality and shelf life of their products. The growing popularity of wine, particularly in emerging markets, is likely to further bolster the sulfure dioxide demand, thereby reinforcing its importance in the Sulfure Dioxide Market.

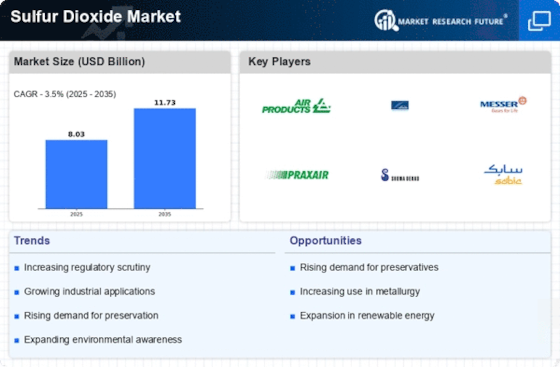

Increasing Industrial Applications

The Sulfure Dioxide Market is experiencing a notable increase in demand due to its diverse applications across various industrial sectors. Sulfure dioxide is extensively utilized in the production of sulfuric acid, which is a fundamental chemical in the manufacturing of fertilizers, chemicals, and petroleum refining. The fertilizer industry, in particular, has shown a robust growth trajectory, with projections indicating a compound annual growth rate of approximately 3.5% over the next few years. This growth is likely to drive the demand for sulfure dioxide as a key input in the production process. Furthermore, the paper and pulp industry also relies on sulfure dioxide for bleaching processes, further solidifying its position in the market. As industries continue to expand, the Sulfure Dioxide Market is poised for sustained growth.

Technological Advancements in Production

Technological advancements in the production of sulfure dioxide are playing a pivotal role in shaping the Sulfure Dioxide Market. Innovations in manufacturing processes have led to more efficient and environmentally friendly methods of production, which not only reduce costs but also minimize emissions. For instance, the development of advanced catalytic processes has improved the yield and purity of sulfure dioxide, making it more appealing to industries that prioritize quality. Additionally, these advancements are likely to enhance the overall competitiveness of sulfure dioxide in various applications, including food preservation and chemical manufacturing. As industries increasingly adopt these technologies, the Sulfure Dioxide Market is expected to witness a surge in demand driven by improved production capabilities.

Regulatory Compliance and Environmental Standards

The Sulfure Dioxide Market is significantly impacted by regulatory compliance and environmental standards that govern the use of chemicals. Governments and regulatory agencies are increasingly implementing stringent regulations regarding emissions and the use of sulfure dioxide in various applications. These regulations aim to mitigate environmental impacts and promote sustainable practices. As a result, industries utilizing sulfure dioxide are compelled to adopt cleaner technologies and practices to comply with these standards. This shift not only enhances the sustainability of the Sulfure Dioxide Market but also opens up opportunities for innovation in production methods. Companies that proactively adapt to these regulations may gain a competitive edge, thereby influencing the overall dynamics of the sulfure dioxide market.