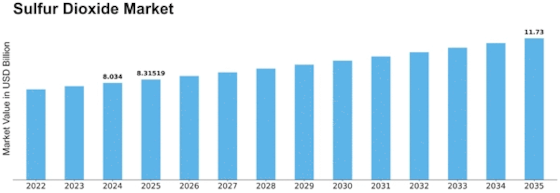

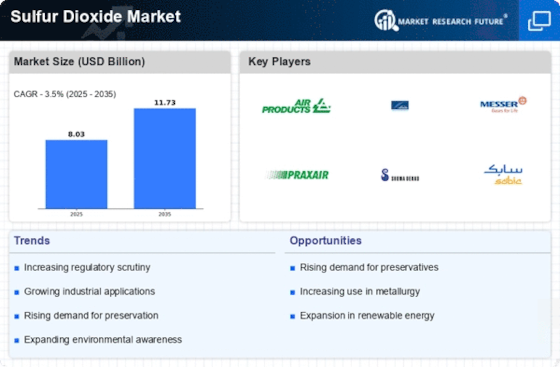

Sulfur Dioxide Size

Sulfur Dioxide Market Growth Projections and Opportunities

The Sulfur Dioxide market is influenced by various factors that contribute to its dynamics and growth. One significant factor is the widespread use of sulfur dioxide across industries such as chemicals, food and beverages, pharmaceuticals, and agriculture. Sulfur dioxide is primarily used in the production of sulfuric acid, a key industrial chemical used in the manufacture of fertilizers, detergents, batteries, and various industrial processes. Additionally, sulfur dioxide is used as a preservative in the food and beverage industry to prevent microbial growth and oxidation in products such as wine, dried fruits, and canned goods. Moreover, sulfur dioxide finds applications in pharmaceuticals as a reducing agent and antioxidant, as well as in agriculture as a fumigant and pesticide. The diverse range of applications drives the demand for sulfur dioxide across multiple sectors, contributing to market growth.

Furthermore, regulatory factors play a crucial role in shaping the Sulfur Dioxide market. Sulfur dioxide emissions are subject to strict regulations and emission standards due to their environmental and health impacts. Regulatory agencies such as the Environmental Protection Agency (EPA) in the United States and the European Environment Agency (EEA) in Europe impose limits on sulfur dioxide emissions from industrial sources such as power plants, refineries, and manufacturing facilities. Compliance with these regulations requires the installation of pollution control equipment such as scrubbers and catalytic converters, driving demand for sulfur dioxide in emission control applications.

Moreover, technological advancements play a significant role in shaping the Sulfur Dioxide market. Continuous innovation in sulfur dioxide production processes, purification techniques, and emission control technologies has led to improvements in efficiency, safety, and environmental performance. Advanced technologies such as wet scrubbers, dry scrubbers, and flue gas desulfurization systems enable industries to reduce sulfur dioxide emissions and comply with regulatory requirements effectively. These advancements drive market expansion and adoption of sulfur dioxide-based solutions for emission control and industrial applications.

Market competition also influences the Sulfur Dioxide market. The market is characterized by numerous manufacturers and suppliers offering sulfur dioxide products and emission control solutions. Competitive pricing strategies, product differentiation, and marketing initiatives drive market competition and influence consumer purchasing decisions. Additionally, strategic partnerships, mergers, and acquisitions shape the competitive landscape and market opportunities in the sulfur dioxide market.

Economic factors play a significant role in shaping the Sulfur Dioxide market. Economic conditions such as GDP growth, industrial output, and consumer spending influence demand for sulfur dioxide products across various industries. During periods of economic expansion, increased industrial activity, construction, and infrastructure development drive demand for sulfur dioxide for applications such as sulfuric acid production and emission control. Economic downturns may lead to temporary slowdowns in market growth as industries reduce production and investment.

Furthermore, the availability and cost of raw materials impact the production and pricing of sulfur dioxide. Sulfur dioxide is primarily derived from the combustion of sulfur-containing fuels such as coal, oil, and natural gas. Fluctuations in the prices of these raw materials, as well as sulfur prices, supply chain disruptions, and geopolitical factors, can affect production costs and profit margins for sulfur dioxide manufacturers, influencing market dynamics.

Global market trends and geopolitical factors also influence the Sulfur Dioxide market. Factors such as trade policies, tariffs, currency exchange rates, and geopolitical tensions can impact market dynamics, trade flows, and supply chain logistics, affecting the availability and pricing of sulfur dioxide products in different regions. Additionally, changing energy policies, environmental regulations, and technological advancements shape market opportunities and investment trends in the sulfur dioxide market.

Leave a Comment