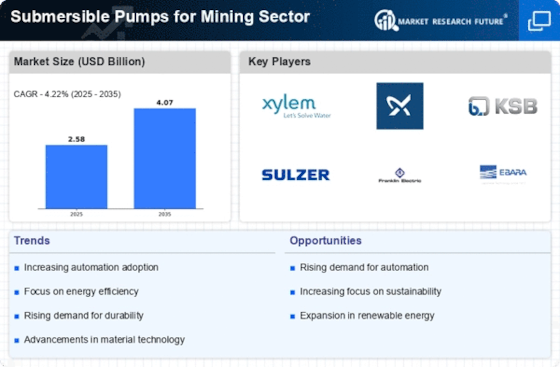

Key market players are emphasizing significantly on R&D for increasing their product offerings, which will further help the Submersible pumps for mining sector Market to grow considerably. Market players are adopting several business development strategies such as acquisitions, mergers, collaborations, and partnerships to enhance their market presence and acquire a larger customer base. To survive in the competitive market, industry players must provide cost effective products.

The submersible pumps for mining sector market is very competitive with market players trying to develop unique and innovative products and solutions, which could render the competitors’ offerings obsolete. The competitive environment is likely to grow further owing to rising technological advancements. Some of the key players operating in the submersible pumps for mining sector market are Xylem, KSB Group, Flowserve Corporation, Ebara Corporation, Tsurumi Manufacturing Co. Ltd, The Gorman-Rupp Company , Atlas Copco AB, The Weir Group Plc, Sulzer Ltd, Grundfos (Denmark). To increase their global reach and client base, key firms are concentrating on acquisitions and product innovation.

Xylem:Xylem is the global provider of products and services related to water technology for industrial, commercial, utility and residential markets. Company manufactures and design highly engineered solutions and products across wide range of applications and caters to the customers of array of industries such as agriculture & irrigation, energy & power, oil & gas, construction, food & beverage, aquaculture, residential, mining, and life sciences, among others.

Its products and services include varies types of pumps, heat exchangers, hydro turbines, wastewater treatment systems and communication & data transfer devices. The company makes its products available under the brand names Aanderaa, ebro, CentriPro, Jabsco, Lowara, Flygt and Flojet, among others. With more than 100+ years of industry experience, the company operates in over 150 countries worldwide.

The company enables the production of its wide product offerings through its production facilities spread over different areas of Europe, North America, South America, Asia, and the Middle East.

KSB Group:KSB Group operates its business in the category of pumps and valves. The company also offers customized products for energy and mining sectors along with offering standard products. With a large workforce engaged in production, development, service and sales, company manages to offer products for sectors such as Petrochemicals, energy, water, mining, and building. The products manufactured by the company are designed to offer long service life, optimal energy efficiency and minimal wear.

With a total of 33 manufacturing sites and representatives and subsidiaries in more than 100 countries, the company makes its products available to customers in different parts of the world. Furthermore, company has 190 service centres, with more than 3,500 service and maintenance staff. Moreover, the company has its test laboratory which is ISO/IEC 17025-accredited, where the manufactured products undergo chemical analyses and mechanical testing for ensuring their quality and reliability.