Technological Innovations in Pump Design

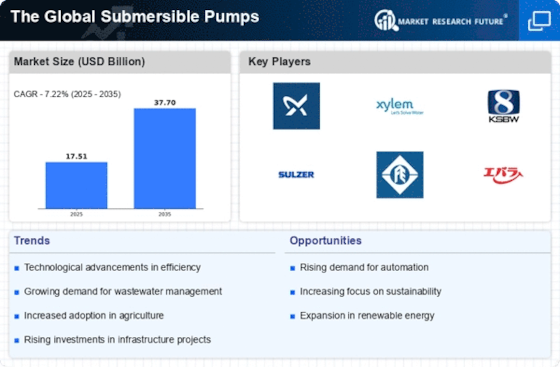

Technological innovations in pump design and manufacturing processes are transforming The Global Submersible Pumps Industry. Advances in materials, energy efficiency, and smart technology integration are enhancing the performance and reliability of submersible pumps. For instance, the introduction of variable frequency drives (VFDs) allows for better control of pump operations, leading to energy savings and reduced operational costs. The market for energy-efficient pumps is expected to grow, driven by regulatory standards and consumer preferences for sustainable solutions. These innovations not only improve pump efficiency but also expand their applications across various sectors, thereby fostering market growth.

Agricultural Expansion and Irrigation Needs

The expansion of agricultural activities and the increasing need for efficient irrigation systems are pivotal drivers for The Global Submersible Pumps Industry. As food production demands rise, farmers are increasingly adopting advanced irrigation techniques to enhance crop yields. Submersible pumps play a crucial role in providing water for irrigation, especially in regions facing water scarcity. The Global Submersible Pumps Market is projected to grow significantly, with submersible pumps being a preferred choice due to their efficiency and reliability. This trend highlights the potential for growth in the submersible pump sector as agricultural practices evolve to meet the challenges of food security.

Industrial Growth and Infrastructure Development

The ongoing industrial growth and infrastructure development across various regions significantly influence The Global Submersible Pumps Industry. Industries such as oil and gas, mining, and construction require robust pumping solutions for efficient operations. The Global Submersible Pumps Market is anticipated to reach USD 10 trillion by 2025, which suggests a growing need for submersible pumps in dewatering and fluid transfer applications. Furthermore, the expansion of industrial facilities necessitates reliable pumping systems to manage water and other fluids effectively. This trend indicates a promising outlook for submersible pump manufacturers as they cater to the evolving needs of diverse industries.

Environmental Regulations and Sustainability Initiatives

The increasing emphasis on environmental regulations and sustainability initiatives is shaping The Global Submersible Pumps Industry. Governments and organizations are implementing stringent regulations to minimize environmental impact, particularly in water management and industrial processes. Submersible pumps, known for their efficiency and lower energy consumption, align well with these sustainability goals. The global push towards reducing carbon footprints and promoting eco-friendly technologies is likely to drive demand for submersible pumps that meet these criteria. As industries adapt to comply with environmental standards, the market for submersible pumps is expected to expand, reflecting a growing commitment to sustainable practices.

Rising Demand for Water Supply and Wastewater Management

The increasing need for efficient water supply and wastewater management systems is a primary driver for The Global Submersible Pumps Industry. Urbanization and population growth have led to heightened demand for reliable water sources and effective sewage disposal. According to recent data, The Global Submersible Pumps Market is projected to reach USD 1 trillion by 2025, indicating a substantial opportunity for submersible pump manufacturers. These pumps are essential in various applications, including municipal water supply, industrial processes, and agricultural irrigation. As governments and organizations invest in infrastructure development, the demand for submersible pumps is expected to rise, thereby propelling the market forward.