Submarine Power Cable Size

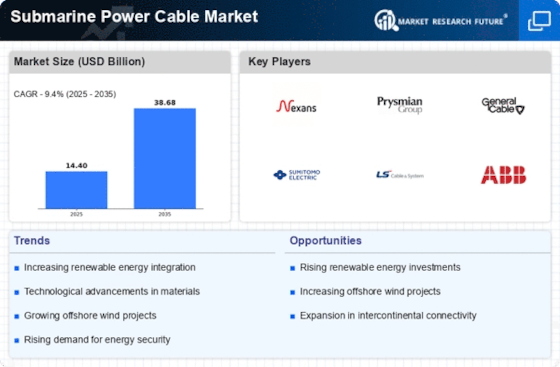

Submarine Power Cable Market Growth Projections and Opportunities

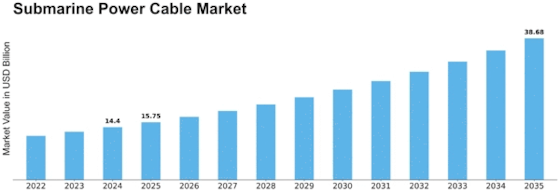

However, the submarine power cable market is driven by numerous elements that cumulatively determine its performance and evolution. The main factor is the growing need for reliable and efficient transfer of energy in underwater conditions. While countries try to increase their renewable energy capacities, there is a necessity of submarine cables that run offshore wind farms connected with onshore grid in this regard has increased greatly. This increase in renewable projects together with the global push towards cleaner sources of power works as a significant growth indicator for this market. Moreover, the increasing international energy trade has accentuated the need for submarine power cables. These cables are essential in power networks that span over borders as they enable the import and export of electricity between countries. Integration of regional power systems is considered to be a rational step aiming at the efficient use of energy resources, increased energy security and development a more cohesive interdependent global system. The market is also influenced by the technological advancements in submarine cable design and manufacturing. Innovative systems like the HVDC technology have revolutionized submarine power cables to be more efficient and lesser costly. HVDC systems are used for long-distance power transmission as a market trend. The development of innovative insulation materials and better methods for laying down cables also contributes to the overall effectiveness and dependability associated with submarine power lines, affecting their buying choices. Additionally, the submarine power cable market relies on government policies and regulatory frameworks. Governments play a vital role in the design of the energy structure, and policies favoring renewable projects as well as cross-border trade enable positive conditions for market growth. It is also necessary to guarantee regulatory stability and provide unambiguous guidelines on submarine cable installation and maintenance, which are the very conditions that ensure investments coming into projects. The submarine power cable market is also driven by the economic terrain. Infrastructure development, industrialization and urbanization are economic factors that make the demand for electricity. With the development of economies, so will be growth in demand for reliable and efficient power transmission which is met with raising installation of submarine power cables to meet rising energy needs. Contrastingly, market barriers like high first setup price and the nature of submarine cable projects can affect the growth. However, the capital-intensive nature of these projects often entails large upfront investments that can serve as a barrier to prospective investors and developers. Further, the situation with underwater cable installation and maintenance is complicated by technical difficulties that demand specific skills.

Leave a Comment