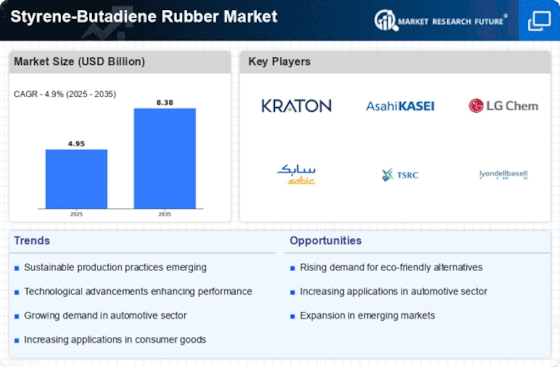

Leading market players are investing heavily in research and development to expand their product lines, which will help the styrene-butadiene rubber market grow even more. Market participants are also undertaking various strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, styrene–butadiene rubber industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics manufacturer’s uses in the styrene-butadiene rubber industry to benefit clients and increase the market sector. In recent years, the styrene-butadiene rubber industry has offered automobiles some of the most significant advantages.

Major players in the styrene-butadiene rubber market, including Rockwood Lithium, AkzoNobel, Chemtura, Asahi Kasei, Bridgestone, LANXESS, MICHELIN, China Petroleum & Chemical, JSR, Reliance Industries Limited (India), Zeon Corporation (Japan), LG Chem (South Korea),Trinseo (US), KUMHO PETROCHEMICAL (South Korea), Goodyear Rubber Company (US) and others, are attempting to increase market demand by investing in research and development operations.

China Petroleum & Chemical Corp.'s Hainan Baling Chemical New Material Co., Ltd. initiated the manufacture of a styrene-butadiene copolymer (SBC) project in Hainan, China, in 2023. It can handle 170,000 tons of cargo annually. The largest SBC plants in the world are currently found in Sinopec. Rubber elasticity can be achieved at ambient temperature and high temperatures can be used to plasticize thermoplastic elastomer (TPE) copolymers. SBC is a subtype of thermoplastic polyethylene (TPE), and its products, such as SBS, SEBS, SIS, and SEPS, are extensively utilized in food packaging, automotives, consumer electronics, footwear, asphalt modification, resin modification, and adhesives.

ARLANXEO is a world-leading synthetic rubber company with sales of around EUR 3.0 billion in 2019, about 3,900 employees, and a presence at 12 production sites in 9 countries and seven innovation centers worldwide. Headquartered in The Hague, Netherlands, the company's core business is developing, manufacturing, and marketing synthetic high-performance rubber for use in the automotive and Tire industries, construction industries, and oil and gas industries.

ARLANXEO was established in April 2016 as a joint venture of LANXESS - a world-leading specialty chemicals company based in Cologne, Germany - and Saudi Aramco - a major energy and chemicals enterprise headquartered in Dhahran, Saudi Arabia. The two partners each held a 50% interest in the joint venture. Since December 31, 2018, ARLANXEO has been a wholly-owned subsidiary of Saudi Aramco, a leading producer of energy and chemicals.Arlanxeo inaugurated a new 65 kilotonne-per-annum (ktpa) polybutadiene (PBR) production line in southern Brazil. The new plant will help increase the flexibility of rubber production at the Triunfo facility.

Asahi Kasei Corporation is a multinational Japanese chemical company. Its main products are chemicals and materials science. It was founded in May 1931, using Nobeoka Ammonia Fiber Co., Ltd.'s paid-in capital, a Nobeoka, Miyazaki-based producer of ammonia, nitric acid, and other chemicals. Asahi Kasei Corporation began the sale of Tufdene S-SBR (solution-polymerized styrene-butadiene rubber), and Asadene BR (butadiene rubber) made using the mass-balance method at Asahi Kasei Synthetic Rubber Singapore Pte. Ltd. and the Synthetic Rubber Plant of Asahi Kasei's Kawasaki Works.

The sale will be based on the ISCC PLUS2 certification for S-SBR and BR, acquired by Asahi Kasei's Synthetic Rubber Division in October 2022.