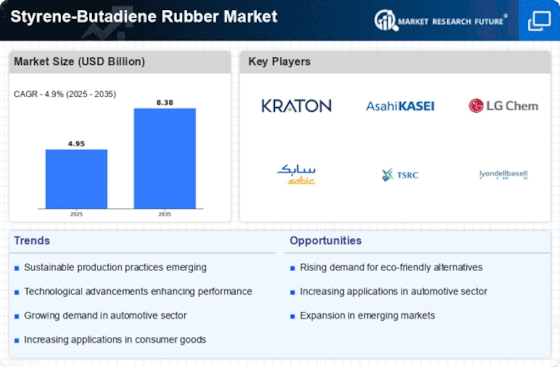

Top Industry Leaders in the Styrene-Butadiene Rubber market

Styrene-butadiene rubber (SBR), a synthetic rubber widely used in tires, footwear, and construction, finds itself amidst a dynamic and competitive landscape. This report delves into the key players, market share factors, industry news, and recent developments shaping the SBR market's trajectory.

Market Giants and Strategies:

-

Asian Dominance: Asian behemoths like Sinopec, Kumho Petrochemical, and Tianjin Lugang hold significant market shares, leveraging cost-effective production and large domestic demand. -

Diversification: Established players like Lanxess and ARLANXEO are focusing on specialty SBR grades cater to niche applications, driving higher margins. -

Vertical Integration: Companies like Asahi Kasei and LG Chem integrate with feedstock suppliers, securing raw material access and cost stability. -

Technological Advancements: Innovation in emulsion and solution SBR processes is reducing energy consumption and environmental impact, attracting eco-conscious customers.

Factors Shaping Market Share:

-

Regional Demand: Asia-Pacific accounts for the largest share, driven by booming automotive and construction sectors. Europe, with stricter regulations on tire performance, offers significant growth potential. -

Application Diversification: Beyond traditional uses, SBR's penetration in medical devices, roofing membranes, and adhesives opens new avenues for market expansion. -

Price Fluctuations: The volatility of feedstock prices, particularly butadiene, creates cost pressures and impacts market dynamics. -

Sustainability Concerns: Environmental regulations and consumer preferences for eco-friendly products push manufacturers towards greener production processes and bio-based SBR alternatives.

Key companies in the styrene-butadiene rubber products market include

- Rockwood Lithium

- AkzoNobel

- Chemtura

- Asahi Kasei

- Bridgestone

- LANXESS

- MICHELIN

- China Petroleum & Chemical

- JSR

- Reliance Industries Limited (India)

- Zeon Corporation (Japan)

- LG Chem (South Korea),

- Trinseo (US)

- KUMHO PETROCHEMICAL (South Korea)

- Goodyear Rubber Company (US)

Recent Developments:

February 2023: Arlanxeo inaugurated a new 65 kilotonne-per-annum (ktpa) polybutadiene (PBR) production line in southern Brazil. The new plant will help increase the flexibility of rubber production at the Triunfo facility.

June 2023: Lanxess announced the expansion of its SBR production capacity in Zhangjiagang, China. The expansion is expected to be completed in 2025 and will increase Lanxess's SBR production capacity in China by 50%.

July 2023: ExxonMobil announced the start-up of its new SBR production plant in Singapore. The plant has a capacity of 150,000 metric tons per year and is ExxonMobil's first SBR plant in Asia.

August 2023: JSR Corporation announced the acquisition of the SBR business of Denka Company. The acquisition will give JSR a significant market share in the global SBR market.

November 2022: Asahi Kasei Corporation began the sale of Tufdene S-SBR (solution-polymerized styrene-butadiene rubber) and Asadene BR (butadiene rubber) made using the mass-balance method at Asahi Kasei Synthetic Rubber Singapore Pte.Ltd. and the Synthetic Rubber Plant of Asahi Kasei's Kawasaki Works. The sale will be based on the ISCC PLUS2 certification for S-SBR and BR, acquired by Asahi Kasei's Synthetic Rubber Division in October 2022.