Student Loan Market Summary

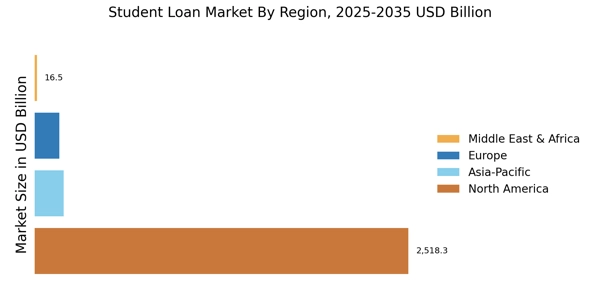

As per Market Research Future analysis, the Student Loan Market Size was estimated at 2798.11 USD Billion in 2024. The Student Loan industry is projected to grow from 3033.72 USD Billion in 2025 to 6808.93 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 8.42% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The student loan market is experiencing transformative shifts driven by technological advancements and evolving borrower needs.

- There is a rising demand for financial literacy programs among borrowers in North America and Asia-Pacific.

- Digital transformation is reshaping loan services, enhancing accessibility and efficiency in both federal and private loan segments.

- Regulatory changes are impacting borrowing practices, particularly in the undergraduate loan segment, which remains the largest.

- Increasing tuition costs and the expansion of income-driven repayment plans are major drivers influencing the market dynamics.

Market Size & Forecast

| 2024 Market Size | 2798.11 (USD Billion) |

| 2035 Market Size | 6808.93 (USD Billion) |

| CAGR (2025 - 2035) | 8.42% |

Major Players

Navient (US), Sallie Mae (US), SoFi (US), Discover Financial Services (US), Citizens Bank (US), Wells Fargo (US), PNC Bank (US), College Ave Student Loans (US), LendKey (US)