Investment Opportunities

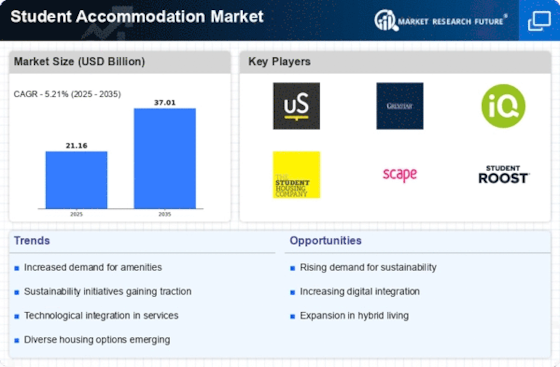

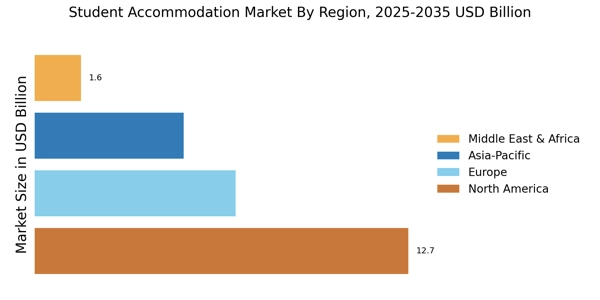

The student accommodation investment market presents compelling opportunities for stakeholders looking to capitalize on the market student accommodation trends. The UK student accommodation market leads globally in terms of professionalization and investor activity, with tier-2 cities like Newcastle gaining traction alongside traditional hubs. As the student accommodation market size is projected to reach $37.01 billion by 2035, investors are increasingly focusing on purpose-built assets that offer modern amenities, sustainable features, and strategic campus proximity. Properties such as Market House student accommodation Newcastle demonstrate the evolution toward premium student living experiences that command higher rental premiums.

Urbanization and Migration Trends

Urbanization continues to shape the landscape of the Student Accommodation Market. As more individuals migrate to urban centers for educational opportunities, the demand for student housing in these areas intensifies. Data indicates that urban populations are projected to grow significantly, with many cities experiencing a surge in student enrollment. This trend necessitates the development of new accommodation facilities, particularly in proximity to universities and colleges. The Student Accommodation Market must respond to this demand by providing a range of housing options, from traditional dormitories to modern, purpose-built student residences. Additionally, urbanization often leads to higher living costs, which may influence students' choices regarding accommodation, thereby impacting market dynamics.

Sustainability and Eco-Friendly Living

Sustainability has emerged as a crucial consideration within the Student Accommodation Market. As awareness of environmental issues increases, students are increasingly seeking eco-friendly living options. This trend is reflected in the growing demand for sustainable housing solutions that minimize carbon footprints and promote energy efficiency. Many accommodation providers are responding by implementing green building practices and offering amenities that support sustainable living, such as recycling programs and energy-efficient appliances. The Student Accommodation Market must prioritize sustainability to attract environmentally conscious students and comply with regulatory standards. This focus on eco-friendly living not only benefits the environment but also enhances the overall appeal of accommodation offerings.

Growing International Student Population

The increasing number of international students pursuing higher education is a primary driver of the Student Accommodation Market. According to recent statistics, the number of international students has been steadily rising, with estimates suggesting that over 5 million students are studying abroad. This trend indicates a robust demand for suitable accommodation options tailored to the needs of these students. As educational institutions expand their global reach, the necessity for diverse housing solutions becomes apparent. The Student Accommodation Market must adapt to cater to various cultural preferences and living arrangements, thereby enhancing the overall student experience. Furthermore, the influx of international students often leads to increased competition among accommodation providers, prompting innovation and improved service offerings.

Changing Student Demographics and Preferences

The demographics of students are evolving, influencing the Student Accommodation Market in various ways. Today's students are more diverse in terms of age, background, and lifestyle preferences. This shift necessitates a reevaluation of accommodation options to cater to a broader range of needs. For instance, there is a growing preference for flexible living arrangements, such as short-term leases and co-living spaces. Additionally, students are increasingly valuing community and social interaction, prompting accommodation providers to create environments that foster collaboration and engagement. The Student Accommodation Market must adapt to these changing preferences by offering innovative housing solutions that resonate with the modern student experience.

Technological Advancements in Accommodation Solutions

The integration of technology into the Student Accommodation Market is transforming how students find and secure housing. Digital platforms and mobile applications are increasingly utilized for property searches, bookings, and management. This shift towards technology-driven solutions enhances accessibility and convenience for students, allowing them to make informed decisions. Moreover, smart home technologies are being incorporated into student residences, offering features such as energy efficiency and enhanced security. As the demand for tech-savvy living environments grows, accommodation providers must innovate to remain competitive. The Student Accommodation Market is likely to see a rise in partnerships with technology firms to develop tailored solutions that meet the evolving needs of students.