Technological Innovations

Technological advancements in the manufacturing of structural insulated panels are poised to enhance their market presence. Innovations such as improved insulation materials and advanced manufacturing techniques are contributing to the development of panels that are not only more efficient but also more cost-effective. The Structural Insulated Panels Market is witnessing the introduction of smart panels that integrate energy-efficient technologies, such as solar energy systems. These innovations are likely to attract a broader customer base, including residential and commercial sectors, as they offer enhanced performance and sustainability. The ongoing research and development efforts in this field suggest a promising future for technologically advanced structural insulated panels.

Sustainability Initiatives

The increasing emphasis on sustainability within the construction sector appears to be a pivotal driver for the Structural Insulated Panels Market. As environmental concerns escalate, builders and architects are gravitating towards materials that offer superior energy efficiency and reduced carbon footprints. Structural insulated panels, known for their excellent insulation properties, contribute to lower energy consumption in buildings. Reports indicate that structures utilizing these panels can achieve energy savings of up to 50% compared to traditional building methods. This trend aligns with global initiatives aimed at reducing greenhouse gas emissions, thereby enhancing the appeal of structural insulated panels in eco-conscious construction projects.

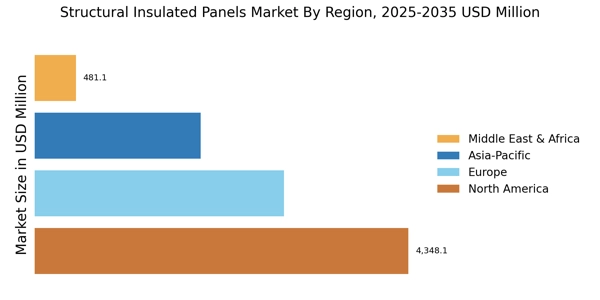

Rising Construction Activities

The resurgence of construction activities across various regions is likely to bolster the Structural Insulated Panels Market. As urbanization accelerates, there is a growing demand for efficient building solutions that can accommodate rapid population growth. Structural insulated panels offer a streamlined construction process, reducing labor costs and timeframes. Data suggests that the construction sector is projected to grow at a compound annual growth rate of approximately 5% over the next few years. This growth is expected to drive the adoption of innovative building materials, including structural insulated panels, as developers seek to optimize project timelines and enhance overall building performance.

Consumer Awareness and Preferences

The growing awareness among consumers regarding energy efficiency and sustainable living is driving the Structural Insulated Panels Market. Homebuyers and commercial property owners are increasingly prioritizing energy-efficient solutions that reduce utility costs and environmental impact. This shift in consumer preferences is prompting builders to incorporate structural insulated panels into their designs. Market Research Future indicates that properties built with these panels can command higher resale values due to their energy-saving capabilities. As consumers continue to seek out sustainable options, the demand for structural insulated panels is likely to increase, reflecting a broader trend towards environmentally responsible construction.

Government Regulations and Incentives

Government regulations aimed at promoting energy efficiency and sustainable building practices are influencing the Structural Insulated Panels Market. Many countries are implementing stricter building codes that mandate the use of energy-efficient materials. These regulations often come with incentives for builders who adopt sustainable practices, further encouraging the use of structural insulated panels. For instance, tax credits and grants for energy-efficient construction can significantly reduce the overall costs for developers. As these regulations become more prevalent, the demand for structural insulated panels is expected to rise, positioning them as a preferred choice in compliant construction projects.