Rising Energy Costs

The increasing cost of energy in India is prompting builders and homeowners to seek energy-efficient solutions, thereby boosting the structural insulated-panels market. As energy prices continue to rise, the demand for materials that enhance thermal insulation and reduce energy consumption is likely to increase. Structural insulated panels provide superior insulation, which can lead to significant savings on heating and cooling costs. This trend is particularly relevant in regions with extreme temperatures, where energy efficiency is crucial. The potential for long-term cost savings makes these panels an appealing option for both residential and commercial construction projects.

Growing Construction Sector

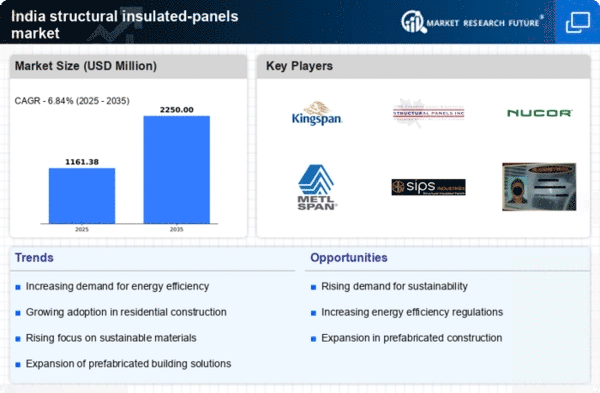

The construction sector in India is experiencing robust growth, driven by urbanization and infrastructure development. The structural insulated-panels market benefits from this trend as builders seek efficient and cost-effective solutions. With the Indian government's focus on housing for all, the demand for innovative building materials is likely to rise. The construction industry is projected to grow at a CAGR of approximately 7.1% from 2021 to 2026, indicating a substantial opportunity for structural insulated-panels. These panels offer advantages such as reduced construction time and improved thermal performance, making them an attractive choice for builders aiming to meet the increasing housing demand.

Increased Awareness of Sustainability

There is a growing awareness of sustainability among consumers and builders in India, which is positively impacting the structural insulated-panels market. As environmental concerns rise, the demand for eco-friendly building materials is increasing. Structural insulated panels are recognized for their energy efficiency and reduced waste during construction. This shift towards sustainable practices is supported by various initiatives from the government, which aims to promote green building standards. The market for sustainable construction materials is expected to grow significantly, with estimates suggesting a CAGR of around 8% over the next few years, further driving the adoption of structural insulated panels.

Technological Innovations in Panel Production

Technological advancements in the production of structural insulated panels are enhancing their appeal in the Indian market. Innovations such as improved manufacturing processes and the use of advanced materials are leading to higher quality and more durable panels. These developments not only improve the performance of structural insulated panels but also reduce production costs, making them more accessible to builders. As the industry embraces these technologies, the structural insulated-panels market is likely to see increased adoption across various construction projects, from residential homes to commercial buildings.

Government Regulations Promoting Energy Efficiency

The Indian government is implementing regulations aimed at promoting energy efficiency in the construction sector, which is likely to benefit the structural insulated-panels market. Policies that encourage the use of energy-efficient materials and practices are becoming more prevalent. These regulations are designed to reduce the carbon footprint of buildings and promote sustainable development. As compliance with these regulations becomes mandatory, builders are expected to increasingly turn to structural insulated panels as a viable solution. This regulatory environment is anticipated to drive market growth, as more construction projects align with energy efficiency standards.