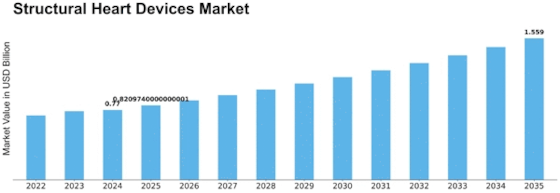

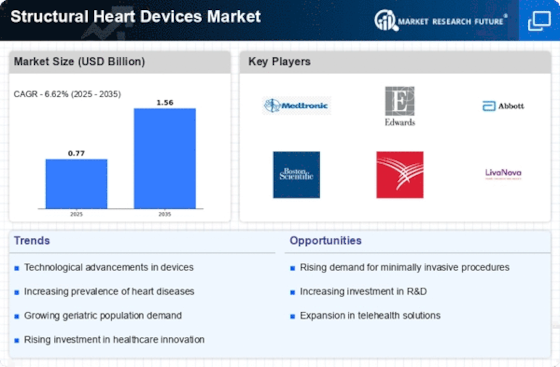

Structural Heart Devices Size

Structural Heart Devices Market Growth Projections and Opportunities

The Structural Heart Devices market is shaped by factors that collectively influence its growth and dynamics. The increasing prevalence of cardiovascular diseases is a key driver, particularly those affecting the structural components of the heart. As the global burden of conditions such as valvular heart diseases and congenital heart defects rises, a growing demand for advanced structural heart devices that offer minimally invasive solutions contributes to the market's expansion. Technological advancements in cardiac interventions are pivotal in shaping the structural heart devices market. Innovations such as transcatheter heart valves left atrial appendage closure devices, and septal occluders provide less invasive alternatives to traditional open-heart surgeries. These technological breakthroughs improve patient outcomes and contribute to the market's competitiveness, with an increasing number of patients opting for less invasive structural heart interventions. The aging population is a significant factor influencing the market. The risk of developing structural heart conditions increases with age, creating a higher demand for interventions that address age-related cardiac issues. Structural heart devices cater to the unique needs of the elderly population, offering therapeutic options that align with their health requirements. Economic factors, including healthcare expenditure and reimbursement policies, impact the Structural Heart Devices market. Increased healthcare spending globally allows for greater investment in advanced cardiac technologies. Additionally, favorable reimbursement policies for structural heart procedures contribute to patient access, influencing the adoption of these devices. Regulatory frameworks and clinical trial outcomes significantly influence the market's landscape. Stringent regulations ensure the safety and efficacy of structural heart devices, guiding manufacturers in their development and commercialization processes. Positive clinical trial results and regulatory approvals are crucial milestones that shape industry practices and instill confidence in healthcare professionals and patients. The increasing prevalence of lifestyle-related risk factors, such as obesity and diabetes, contributes to the rising incidence of structural heart diseases. Lifestyle modifications and risk factor management alone may not be sufficient for certain cardiac conditions, leading to a greater reliance on structural heart devices for effective and timely interventions. Collaborations and partnerships between medical device companies, research institutions, and healthcare organizations contribute to market advancements. Joint efforts drive research initiatives, technological innovations, and the development of new structural heart devices. Collaborative approaches accelerate progress in cardiac interventions, enhancing the range of available patient options. Patient awareness and education campaigns about structural heart conditions and available treatment options are vital in market dynamics. Increased awareness contributes to early diagnosis and intervention, fostering a proactive approach to structural heart health. Patients with information are more likely to seek appropriate medical attention and explore advanced therapeutic options. The influence of healthcare professionals, including interventional cardiologists and cardiac surgeons, cannot be overstated in the Structural Heart Devices market. Physician training, expertise, and preferences impact adopting specific devices and techniques. Continuous medical education and training programs contribute to the proficiency of healthcare providers in performing structural heart interventions. The globalization of healthcare services, including cardiac interventions, is a notable factor in the Structural Heart Devices market. Individuals may seek specialized structural heart procedures with expertise and advanced technologies in regions. The availability of such services globally contributes to a diverse patient demographic and adds to the market's overall growth. Patient outcomes and long-term efficacy are critical considerations in adopting structural heart devices. Positive clinical outcomes reduce procedural risks, and long-term success rates contribute to the market's credibility and influence the decision-making process for both healthcare professionals and patients.

Leave a Comment