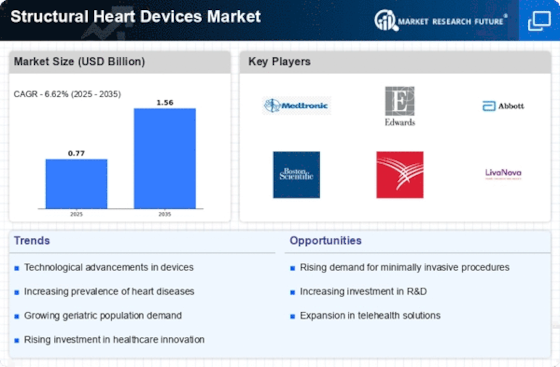

Market Share

Structural Heart Devices Market Share Analysis

Successful positioning begins with a focus on a diverse product portfolio. Structural heart device market companies emphasize various innovative solutions, including transcatheter heart valves, septal occluders, left atrial appendage closure devices, and transcatheter mitral valve repair systems. This comprehensive approach allows them to cater to various structural heart conditions and procedures. Recognizing the global prevalence of structural heart conditions, companies formulate strategies for global market expansion. Adapting to diverse healthcare systems, regulatory frameworks, and patient demographics is essential for establishing a substantial market share on a global scale. Building strong collaborations with cardiologists and cardiovascular centers is crucial for successful positioning. Positioning strategies involve partnerships with leading cardiac specialists, involving them in clinical trials, research, and the development of advanced procedural techniques. These collaborations enhance the expertise and credibility of structural heart device providers. Emphasizing technological innovation is critical. Companies invest in research and development to introduce cutting-edge technologies, such as transcatheter approaches, minimally invasive procedures, and advanced imaging guidance. Continuous innovation ensures that structural heart device providers stay at the forefront of cardiovascular interventions. A patient-centric approach is fundamental for successful positioning in the structural heart devices market. Companies prioritize patient outcomes, providing personalized treatment plans, clear communication, and supportive care. Initiatives such as patient education materials and support programs contribute to informed decision-making and positive patient experiences. Adherence to regulatory standards is imperative in the structural heart devices market. Positioning strategies underscore a commitment to regulatory compliance, focusing on meeting stringent safety, efficacy, and quality standards. This approach builds trust among healthcare professionals, regulatory bodies, and patients. Recognizing the importance of continuous education, positioning strategies include comprehensive initiatives for healthcare professionals. Companies offer training programs, workshops, and resources for cardiologists, cardiac surgeons, and other specialists to ensure they are well-versed in the latest structural heart interventions. Acknowledging the unique characteristics of each patient, positioning strategies highlight the customization of treatment plans. Companies offer tailored structural heart interventions based on individual diagnoses, anatomical considerations, and overall health conditions. This personalized approach contributes to improved patient outcomes and satisfaction. Addressing economic considerations, positioning strategies emphasize affordability and accessibility initiatives. Implementing transparent pricing models, collaborating with healthcare financing providers, and offering reimbursement support contribute to making structural heart interventions more accessible to a broader patient population. Providing robust real-world clinical evidence is crucial for successful positioning. Companies conduct and publish clinical studies demonstrating their structural heart device's safety, effectiveness, and long-term outcomes. Positive real-world evidence contributes to building confidence among healthcare professionals and decision-makers. Emphasizing a commitment to continuous research and development is essential. Positioning strategies highlight ongoing efforts, participation in collaborative research projects, and the exploration of emerging technologies, reinforcing the company's dedication to advancing structural heart interventions. Recognizing the role of digital health, positioning strategies may include integrating digital solutions. Companies leverage remote monitoring, telehealth, and data analytics to enhance post-procedural care, optimize patient outcomes, and facilitate continuous follow-up. Addressing environmental concerns, positioning strategies underscore sustainability practices. Communicating initiatives such as eco-friendly manufacturing processes, energy-efficient facilities, and responsible waste management aligns with growing corporate responsibility and environmental consciousness. Recognizing the emotional and psychological aspects of structural heart conditions, positioning strategies involve patient advocacy and support groups. Companies collaborate with patient organizations, providing platforms for shared experiences, emotional support, and resources to enhance the patient journey. Successful positioning involves strategic mergers and acquisitions. Companies explore opportunities to acquire or partner with complementary businesses, expanding their capabilities and gaining access to new markets. Mergers and acquisitions also enable the integration of diverse expertise and resources.

Leave a Comment