Market Analysis

In-depth Analysis of Structural Heart Devices Market Industry Landscape

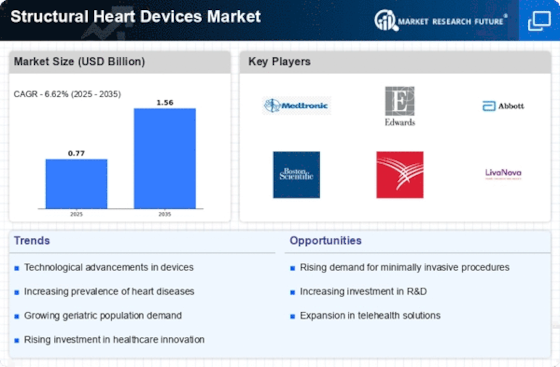

The global structural heart devices market reached USD 9.9 BN in 2022 and is poised to grow to USD 19.66 BN by 2030, registering a 10.30% CAGR during the review period (2023-2030). The market dynamics of structural heart devices are characterized by a confluence of technological advancements, increasing prevalence of cardiovascular diseases, and a paradigm shift toward minimally invasive procedures. Technological innovations in structural heart devices, such as transcatheter heart valves, occluders, and annuloplasty rings, are reshaping the landscape of cardiovascular interventions. These advancements enable more precise and less invasive treatments for structural heart conditions, fostering a trend toward improved patient outcomes and reduced recovery times. The rising prevalence of cardiovascular diseases, particularly structural heart conditions such as valvular defects and congenital anomalies, significantly impacts market dynamics. As the aging population increases and risk factors for heart diseases become more prevalent, the demand for effective and less invasive structural heart interventions rises. Structural heart devices, offering alternatives to traditional open-heart surgeries, meet the growing need for advanced treatment options. Collaborations and partnerships between medical device manufacturers, healthcare institutions, and research organizations influence the competitive landscape. Joint efforts contribute to research and development initiatives, driving innovation in structural heart technologies and expanding the product portfolio. Regulatory compliance and adherence to stringent quality standards are paramount, ensuring the safety and efficacy of structural heart devices and shaping market dynamics. Minimally invasive procedures, facilitated by structural heart devices, are a defining aspect of market dynamics. Transcatheter interventions, in particular, have gained prominence, allowing for treatments without open-heart surgery. This shift toward less invasive procedures aligns with patient preferences and contributes to the market's overall growth. With the aging population and an increased prevalence of lifestyle-related cardiovascular risk factors, the global demographic landscape influences market dynamics. Structural heart devices become integral in addressing the healthcare needs of an aging demographic, focusing on improving both quality of life and life expectancy. Economic factors, including healthcare expenditure and reimbursement policies, contribute to market dynamics by influencing the accessibility of structural heart interventions. Efforts to make these advanced treatments more economically viable and accessible contribute to the market's overall growth. Educational initiatives and training programs for healthcare professionals play a significant role in market dynamics. As structural heart interventions become more sophisticated, specialized training and expertise are needed. Educational initiatives contribute to the skill development of healthcare providers, ensuring the effective utilization of advanced structural heart devices. Psychosocial factors impact market dynamics, such as patient awareness and preferences for minimally invasive treatments. Patient education and awareness campaigns are crucial in shaping the demand for structural heart interventions as informed patients increasingly seek less invasive options for their cardiovascular conditions.

Leave a Comment