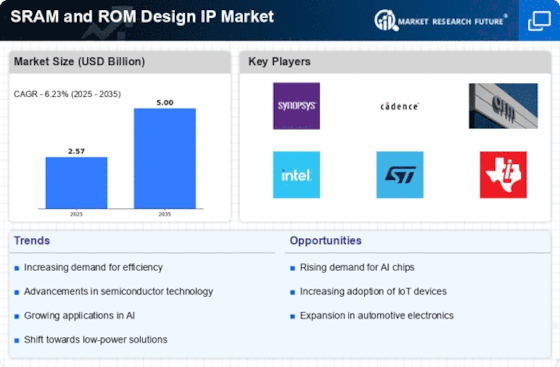

Increasing Adoption of IoT Devices

The proliferation of Internet of Things (IoT) devices is a significant driver for the SRAM and ROM Design IP Market. As more devices become interconnected, the demand for efficient memory solutions that can handle real-time data processing and storage is escalating. It is estimated that the number of IoT devices will exceed 30 billion by 2025, creating a substantial market for SRAM and ROM design IP. These memory types are essential for enabling the functionality of IoT devices, which require low power consumption and high reliability. Consequently, manufacturers are focusing on developing specialized SRAM and ROM design IP tailored for IoT applications, indicating a promising growth trajectory for the market.

Shift Towards Customizable Solutions

The trend towards customization in electronic design is becoming increasingly prominent within the SRAM and ROM Design IP Market. As companies seek to differentiate their products, the demand for customizable memory solutions is rising. This shift is particularly evident in sectors such as consumer electronics and telecommunications, where tailored memory solutions can provide competitive advantages. The market for customizable SRAM and ROM design IP is expected to expand, with manufacturers investing in flexible design methodologies that allow for rapid prototyping and adaptation to specific application needs. This trend not only enhances product offerings but also fosters innovation within the SRAM and ROM Design IP Market, suggesting a dynamic future for memory solutions.

Advancements in Semiconductor Technology

Technological advancements in semiconductor manufacturing are significantly influencing the SRAM and ROM Design IP Market. Innovations such as FinFET technology and 3D NAND are enhancing the performance and efficiency of memory devices. These advancements allow for smaller, faster, and more energy-efficient memory solutions, which are crucial for modern applications. The semiconductor industry has seen a consistent investment in research and development, with expenditures reaching billions annually. This investment is likely to foster the development of cutting-edge SRAM and ROM design IP, enabling manufacturers to produce high-quality products that meet the stringent requirements of contemporary electronic devices. As a result, the SRAM and ROM Design IP Market is poised for growth, driven by these technological breakthroughs.

Growing Emphasis on Automotive Electronics

The automotive sector's increasing reliance on advanced electronics is driving the SRAM and ROM Design IP Market. With the rise of electric vehicles and autonomous driving technologies, the demand for sophisticated memory solutions is on the rise. Automotive applications require high-performance memory that can withstand extreme conditions while providing reliable data storage and processing capabilities. The automotive electronics market is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 8% in the next few years. This growth is likely to stimulate demand for SRAM and ROM design IP, as manufacturers seek to integrate advanced memory solutions into their automotive systems, thereby enhancing vehicle performance and safety.

Rising Demand for High-Performance Computing

The SRAM and ROM Design IP Market is experiencing a notable surge in demand driven by the increasing need for high-performance computing solutions. As industries such as artificial intelligence, machine learning, and data analytics expand, the requirement for faster and more efficient memory solutions becomes paramount. According to recent data, the market for high-performance computing is projected to grow at a compound annual growth rate of over 10% in the coming years. This growth is likely to propel the SRAM and ROM Design IP Market, as these memory types are essential for processing large datasets and executing complex algorithms efficiently. Consequently, companies are investing in advanced SRAM and ROM design IP to meet these evolving demands, indicating a robust trajectory for the market.