Market Trends

Key Emerging Trends in the Spout Packaging Market

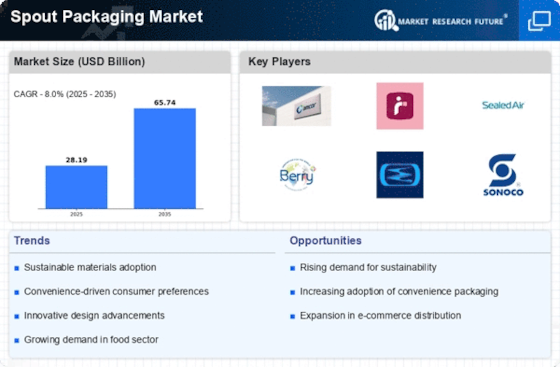

The spout packaging market has been witnessing significant trends in recent years, influenced by changing consumer preferences, technological advancements, and industry regulations. One notable trend is the growing demand for convenient and user-friendly packaging solutions. Consumers are increasingly seeking packaging formats that offer ease of use, portability, and mess-free dispensing. Spout pouches, bottles, and bags are gaining popularity due to their convenient spout openings, which allow for easy pouring, squeezing, and resealing, making them ideal for a wide range of liquid and semi-liquid products such as beverages, sauces, and personal care products.

Moreover, sustainability has emerged as a key trend shaping the spout packaging market. With growing concerns about plastic pollution and environmental sustainability, there is a heightened demand for eco-friendly and recyclable packaging materials. Manufacturers are responding by developing spout pouches and containers made from biodegradable, compostable, and recycled materials, reducing their environmental footprint and appealing to environmentally conscious consumers.

Additionally, there is a noticeable shift towards innovative and functional spout packaging designs aimed at enhancing product differentiation and shelf appeal. Customized spout shapes, sizes, and configurations are being introduced to accommodate various product viscosities, dispensing requirements, and branding preferences. Creative packaging features such as transparent windows, ergonomic grips, and child-resistant closures are also being incorporated to enhance product visibility, usability, and safety.

Furthermore, the spout packaging market is experiencing increased adoption of advanced printing and labeling technologies to enhance brand communication and consumer engagement. High-quality graphics, vibrant colors, and eye-catching designs are being utilized to create visually appealing packaging that stands out on retail shelves and captures consumer attention. Interactive packaging elements such as QR codes, augmented reality (AR) labels, and personalized messaging are also being deployed to provide additional information, promotions, and entertainment to consumers.

In addition to consumer-driven trends, regulatory requirements and industry standards are influencing market dynamics in the spout packaging sector. Stricter regulations on packaging materials, food safety, and sustainability are driving manufacturers to invest in compliance, quality assurance, and certification processes to meet regulatory requirements and ensure consumer safety. This includes adherence to food contact regulations, recycling guidelines, and sustainability certifications to maintain consumer trust and market competitiveness.

Moreover, the COVID-19 pandemic has had a significant impact on the spout packaging market, accelerating certain trends while creating new challenges and opportunities. The shift towards online shopping and home delivery has increased the demand for convenient and portable packaging solutions that are suitable for e-commerce and on-the-go consumption. Spout pouches and flexible containers are well-suited for online retail packaging due to their lightweight, durable, and space-saving properties, making them an attractive option for manufacturers and e-retailers alike.

Leave a Comment