Market Analysis

In-depth Analysis of Spout Packaging Market Industry Landscape

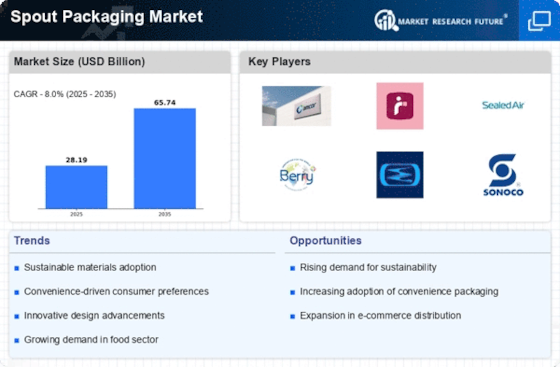

The market dynamics of the spout packaging market are driven by a multitude of factors that shape its growth, trends, and competitive landscape. Spout packaging refers to flexible packaging solutions equipped with a spout for easy dispensing of liquid or semi-liquid products. These dynamics encompass various elements including consumer preferences, technological advancements, regulatory standards, and market competition.

Consumer preferences play a significant role in shaping the market dynamics of spout packaging. With an increasing demand for convenience and on-the-go consumption, consumers favor packaging solutions that offer ease of use and portability. Spout packaging provides a convenient and mess-free way to dispense products such as beverages, sauces, and baby food, aligning with the preferences of modern consumers seeking convenience in their busy lifestyles.

Moreover, technological advancements drive innovation in the spout packaging market, influencing its dynamics. Advancements in materials, printing techniques, and manufacturing processes have led to the development of spout packaging solutions that offer improved functionality, durability, and sustainability. Manufacturers are investing in research and development to introduce innovations such as resealable spouts, barrier films for extended product shelf-life, and lightweight materials to reduce packaging waste.

Regulatory standards also play a crucial role in shaping the market dynamics of spout packaging. Regulatory requirements related to food safety, hygiene, and environmental sustainability drive packaging manufacturers to adhere to stringent standards set by regulatory authorities. Compliance with these standards ensures consumer safety and confidence in the quality of products packaged in spout pouches, influencing purchasing decisions and market growth.

Furthermore, market competition is a key factor influencing the dynamics of the spout packaging market. The market is characterized by the presence of numerous packaging manufacturers competing to offer innovative and cost-effective solutions. Companies engage in competitive pricing strategies, product differentiation, and strategic partnerships to gain a competitive edge and capture market share. Additionally, mergers and acquisitions in the industry contribute to market consolidation and influence competitive dynamics.

Environmental sustainability has emerged as a significant factor influencing market dynamics in the spout packaging market. With growing concerns over plastic pollution and environmental degradation, there is a heightened demand for sustainable packaging alternatives. Manufacturers are increasingly focusing on developing spout pouches made from recyclable materials, biodegradable films, and compostable options to address environmental concerns and meet consumer preferences for eco-friendly packaging solutions.

Supply chain complexities also impact the market dynamics of spout packaging. Factors such as raw material availability, transportation costs, and geopolitical tensions can affect production and distribution channels, leading to fluctuations in market demand and pricing. Additionally, economic conditions and consumer purchasing power influence market dynamics, with changes in disposable income levels and spending patterns impacting the demand for spout packaging products.

Leave a Comment