Regulatory Support and Guidelines

Regulatory support and the establishment of guidelines for respiratory health are pivotal drivers for the Spirometry Market. Various health authorities are advocating for the use of spirometry in clinical practice, which is likely to enhance its adoption among healthcare providers. These guidelines often emphasize the importance of regular lung function testing, particularly for high-risk populations. As regulatory bodies continue to promote best practices in respiratory care, the demand for spirometry devices is expected to grow. Furthermore, compliance with these regulations may encourage healthcare facilities to invest in spirometry technology, thereby expanding the market. The alignment of regulatory frameworks with clinical needs is crucial for fostering innovation and ensuring the availability of high-quality spirometry devices.

Growing Awareness of Respiratory Health

The increasing awareness of respiratory health among the general population is a significant driver for the Spirometry Market. Educational campaigns and public health initiatives are playing a crucial role in informing individuals about the importance of lung function testing. As more people recognize the impact of respiratory diseases on quality of life, there is a growing demand for spirometry testing as a preventive measure. Market data indicates that awareness programs are leading to higher rates of screening and diagnosis, which in turn drives the need for spirometry devices. This heightened awareness not only encourages individuals to seek testing but also motivates healthcare providers to incorporate spirometry into routine assessments, thereby expanding its utilization in various healthcare settings.

Increased Focus on Preventive Healthcare

The growing emphasis on preventive healthcare is shaping the Spirometry Market. As healthcare systems worldwide shift towards proactive management of health conditions, spirometry is increasingly recognized as a vital tool for early detection of respiratory issues. This trend is supported by initiatives aimed at promoting lung health and reducing the burden of respiratory diseases. Data indicates that healthcare expenditures on preventive measures are rising, which is likely to enhance the adoption of spirometry in routine health assessments. By integrating spirometry into preventive care protocols, healthcare providers can identify at-risk individuals earlier, leading to timely interventions and improved health outcomes. This shift not only benefits patients but also aligns with broader public health goals.

Rising Prevalence of Respiratory Diseases

The increasing incidence of respiratory diseases such as asthma and chronic obstructive pulmonary disease (COPD) is a primary driver for the Spirometry Market. According to recent data, respiratory diseases affect millions of individuals worldwide, leading to a heightened demand for diagnostic tools like spirometers. The World Health Organization indicates that respiratory diseases are among the leading causes of morbidity and mortality, which underscores the necessity for effective monitoring and management. As healthcare providers seek to improve patient outcomes, the adoption of spirometry as a standard diagnostic tool is likely to expand. This trend not only reflects the growing awareness of respiratory health but also emphasizes the critical role of spirometry in early detection and ongoing management of these conditions.

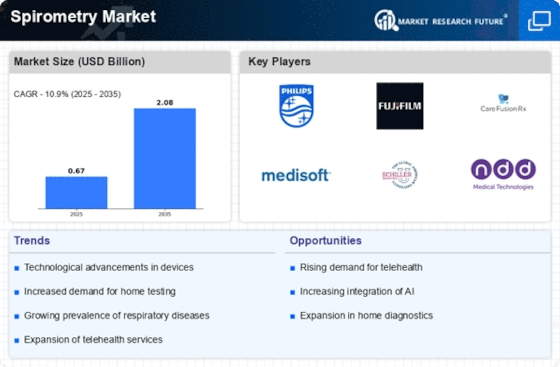

Technological Innovations in Spirometry Devices

Technological advancements in spirometry devices are significantly influencing the Spirometry Market. Innovations such as portable spirometers, smartphone integration, and cloud-based data management systems are enhancing the usability and accessibility of these devices. The introduction of advanced features, including real-time data analysis and remote monitoring capabilities, is likely to attract both healthcare professionals and patients. Market data suggests that the demand for user-friendly and efficient spirometry devices is on the rise, as they facilitate better patient engagement and adherence to treatment plans. Furthermore, these innovations are expected to drive competition among manufacturers, leading to improved product offerings and potentially lower prices, thereby expanding the market reach.