E-commerce Growth

The rapid growth of e-commerce is significantly impacting the Specialty Tin Cans Market. As online shopping becomes more prevalent, the demand for packaging that can withstand shipping and handling increases. Specialty tin cans, known for their durability and protective qualities, are well-suited for e-commerce applications. Recent statistics indicate that e-commerce sales are projected to reach $6 trillion by 2024, highlighting the need for packaging solutions that cater to this expanding market. Companies that can effectively market their specialty tin cans for online retail may find new opportunities for growth and increased sales.

Health and Wellness Trends

The Specialty Tin Cans Market is also influenced by the rising health and wellness trends among consumers. As individuals become more health-conscious, there is an increasing demand for products that promote well-being. Specialty tin cans are often used for packaging health-oriented products, such as organic foods and beverages. This shift is reflected in market data, which shows that the organic food sector is expected to grow by 10% annually. Consequently, manufacturers in the Specialty Tin Cans Market may need to adapt their offerings to align with these health trends, ensuring that their products meet the expectations of a health-focused consumer base.

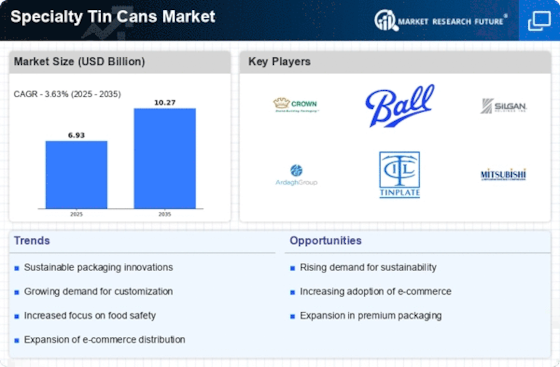

Sustainability Initiatives

The Specialty Tin Cans Market is increasingly influenced by sustainability initiatives. As consumers become more environmentally conscious, there is a growing demand for packaging solutions that minimize ecological impact. Specialty tin cans, being recyclable and often made from recycled materials, align well with these consumer preferences. In fact, recent data indicates that the market for sustainable packaging is projected to grow at a compound annual growth rate of 7.5% over the next five years. This trend suggests that manufacturers in the Specialty Tin Cans Market may need to innovate further to meet the rising expectations for eco-friendly products. Companies that prioritize sustainability in their production processes are likely to gain a competitive edge, appealing to a demographic that values environmental responsibility.

Technological Advancements

Technological advancements play a pivotal role in shaping the Specialty Tin Cans Market. Innovations in manufacturing processes, such as improved coating technologies and enhanced printing techniques, allow for greater customization and efficiency. For instance, the introduction of digital printing on tin cans enables brands to create unique designs that cater to specific consumer preferences. Moreover, automation in production lines has the potential to reduce costs and increase output, thereby meeting the growing demand for specialty cans. As the market evolves, companies that leverage these technological advancements may find themselves better positioned to capture market share and respond to consumer trends effectively.

Consumer Preferences for Unique Packaging

Consumer preferences for unique and aesthetically pleasing packaging are driving changes in the Specialty Tin Cans Market. As brands seek to differentiate themselves in a crowded marketplace, the visual appeal of packaging becomes paramount. Specialty tin cans offer a canvas for creative designs, which can enhance brand recognition and consumer engagement. Market Research Future suggests that products with distinctive packaging can command higher prices and foster brand loyalty. Therefore, manufacturers in the Specialty Tin Cans Market may need to invest in innovative design solutions to meet the evolving tastes of consumers who prioritize both functionality and aesthetics.