Regulatory Compliance

Regulatory compliance plays a crucial role in shaping the Tin Cannabis Packaging Market. As cannabis legalization expands, governments are implementing stringent packaging regulations to ensure consumer safety and product integrity. For instance, packaging must often include child-resistant features and clear labeling of contents. This regulatory landscape creates a demand for innovative tin packaging solutions that meet these requirements. The market for compliant packaging is expected to grow significantly, with estimates suggesting a compound annual growth rate of 8% over the next five years. Thus, companies that invest in compliant tin packaging are likely to thrive in the evolving Tin Cannabis Packaging Market.

Sustainability Initiatives

The Tin Cannabis Packaging Market is increasingly influenced by sustainability initiatives. As consumers become more environmentally conscious, there is a growing demand for packaging solutions that minimize ecological impact. Tin, being recyclable and durable, aligns well with these sustainability goals. In fact, the market for sustainable packaging is projected to reach USD 500 billion by 2027, indicating a robust shift towards eco-friendly materials. This trend not only appeals to consumers but also encourages manufacturers to adopt greener practices, thereby enhancing their brand image. Consequently, companies that prioritize sustainable tin packaging are likely to gain a competitive edge in the Tin Cannabis Packaging Market.

Technological Advancements

Technological advancements are reshaping the Tin Cannabis Packaging Market. Innovations in packaging technology, such as advanced printing techniques and smart packaging solutions, are enhancing the functionality and appeal of tin packaging. These advancements allow for better branding opportunities and improved consumer engagement through features like QR codes and interactive designs. The integration of technology in packaging is projected to increase market value, with estimates suggesting a growth rate of 10% annually. As manufacturers adopt these technologies, the Tin Cannabis Packaging Market is likely to witness a transformation that aligns with modern consumer expectations.

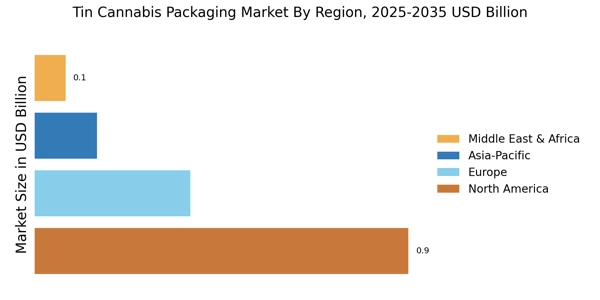

Market Expansion Opportunities

Market expansion opportunities are emerging within the Tin Cannabis Packaging Market. As cannabis legalization spreads across various regions, new markets are opening up for tin packaging solutions. This expansion is not limited to recreational use; medicinal cannabis is also gaining traction, necessitating specialized packaging that ensures product safety and compliance. The potential for market growth is substantial, with projections indicating that the cannabis packaging market could reach USD 30 billion by 2026. Companies that strategically position themselves to capitalize on these emerging markets are likely to experience significant growth within the Tin Cannabis Packaging Market.

Consumer Preferences for Quality

Consumer preferences for quality are driving the Tin Cannabis Packaging Market. As the cannabis market matures, consumers are increasingly discerning about product quality, including packaging. High-quality tin packaging not only preserves the freshness and potency of cannabis products but also enhances the overall consumer experience. Research indicates that 70% of consumers associate premium packaging with superior product quality. This perception encourages manufacturers to invest in high-quality tin packaging solutions, thereby elevating their brand positioning. As a result, the demand for quality-focused tin packaging is expected to rise, further propelling growth in the Tin Cannabis Packaging Market.