Expansion of the Construction Sector

The Specialty Tapes Market is significantly bolstered by the expansion of the construction sector, which relies heavily on specialty tapes for various applications, including insulation, sealing, and surface protection. As urbanization continues to rise, the demand for construction materials and solutions is expected to increase, thereby driving the need for specialty tapes. Market data suggests that the construction segment is likely to grow at a rate of approximately 6% annually, reflecting the ongoing investments in infrastructure and residential projects. This growth highlights the essential role specialty tapes play in enhancing the efficiency and effectiveness of construction processes.

Innovations in Adhesive Technologies

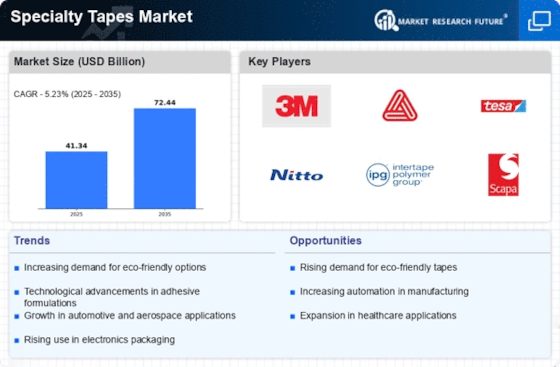

Innovations in adhesive technologies are reshaping the Specialty Tapes Market, leading to the development of advanced products that offer superior performance. Manufacturers are investing in research and development to create specialty tapes with enhanced adhesion, temperature resistance, and durability. These innovations cater to diverse applications across various industries, including construction, automotive, and healthcare. The introduction of new adhesive formulations is likely to expand the market, as companies seek solutions that meet stringent regulatory standards and performance criteria. As a result, the specialty tapes market is expected to grow at a rate of approximately 4% annually, driven by these technological advancements.

Rising Demand from Automotive Sector

The Specialty Tapes Market experiences a notable surge in demand from the automotive sector, driven by the increasing need for lightweight materials and enhanced performance. Specialty tapes are utilized in various applications, including insulation, bonding, and sealing, which are critical for vehicle assembly and manufacturing. As automotive manufacturers strive to improve fuel efficiency and reduce emissions, the adoption of specialty tapes is likely to grow. Reports indicate that the automotive segment accounts for a substantial share of the specialty tapes market, with projections suggesting a compound annual growth rate of approximately 5% over the next few years. This trend underscores the importance of specialty tapes in meeting the evolving requirements of the automotive industry.

Increasing Focus on Sustainable Solutions

The Specialty Tapes Market is witnessing a shift towards sustainable solutions, as consumers and businesses alike prioritize environmentally friendly products. Manufacturers are increasingly developing specialty tapes using recyclable materials and eco-friendly adhesives, responding to the growing demand for sustainable packaging and construction solutions. This trend is particularly evident in industries such as packaging, where specialty tapes are essential for securing and sealing products. Market analysis indicates that the sustainability trend could drive a growth rate of around 5% in the specialty tapes market, as companies seek to align with environmental regulations and consumer preferences for greener alternatives.

Growth in Electronics and Electrical Applications

The Specialty Tapes Market is significantly influenced by the expansion of the electronics and electrical sectors. Specialty tapes are essential in applications such as insulation, protection, and surface mounting in electronic devices. With the proliferation of smart devices and the Internet of Things, the demand for high-performance specialty tapes is expected to rise. Market data suggests that the electronics segment is poised to witness a growth rate of around 6% annually, reflecting the increasing complexity and miniaturization of electronic components. This growth is indicative of the critical role specialty tapes play in ensuring the reliability and efficiency of electronic products.