Automotive Industry Growth

The adhesive tapes market is significantly influenced by the growth of the automotive sector. As vehicle manufacturers strive for enhanced performance and efficiency, adhesive tapes are increasingly employed in various applications, including interior assembly, exterior bonding, and insulation. The automotive industry has shown a consistent upward trajectory, with production rates indicating a robust demand for adhesive solutions. In fact, adhesive tapes are favored for their lightweight properties, which contribute to fuel efficiency and overall vehicle performance. This trend suggests that as the automotive sector continues to expand, the adhesive tapes market will likely benefit from increased adoption of these materials in vehicle manufacturing and assembly processes.

Healthcare Sector Expansion

The adhesive tapes market is witnessing a significant boost from the healthcare sector, where the demand for medical adhesive tapes is on the rise. These tapes are essential for various applications, including wound care, surgical procedures, and securing medical devices. The healthcare industry has been expanding rapidly, driven by advancements in medical technology and an increasing focus on patient care. Recent statistics indicate that the medical segment of the adhesive tapes market is projected to grow at a substantial rate, reflecting the ongoing need for reliable and effective adhesive solutions in healthcare settings. This growth is likely to propel the adhesive tapes market forward, as manufacturers innovate to develop specialized products that meet stringent regulatory requirements.

Construction Industry Demand

The adhesive tapes market is also benefiting from the robust growth of the construction sector. As construction projects become more complex, the need for reliable bonding solutions has intensified. Adhesive tapes are increasingly utilized for insulation, sealing, and surface protection in various construction applications. The construction industry has shown resilience, with ongoing infrastructure projects and residential developments driving demand for adhesive solutions. Recent data suggests that the construction segment is a key contributor to the adhesive tapes market, as builders and contractors seek efficient and durable materials. This trend indicates that the adhesive tapes market will likely continue to thrive, supported by the ongoing expansion of construction activities.

Consumer Electronics Innovation

The adhesive tapes market is experiencing growth driven by innovations in the consumer electronics sector. As technology advances, manufacturers are increasingly utilizing adhesive tapes for assembling electronic devices, including smartphones, tablets, and wearables. These tapes provide essential benefits such as lightweight construction, flexibility, and strong bonding capabilities, which are crucial for modern electronic applications. The consumer electronics market has shown a steady increase in demand, with new product launches and technological advancements fueling this growth. Consequently, the adhesive tapes market is likely to see continued expansion as manufacturers adapt to the evolving needs of the consumer electronics sector, creating specialized adhesive solutions that cater to this dynamic market.

Rising Demand in Packaging Sector

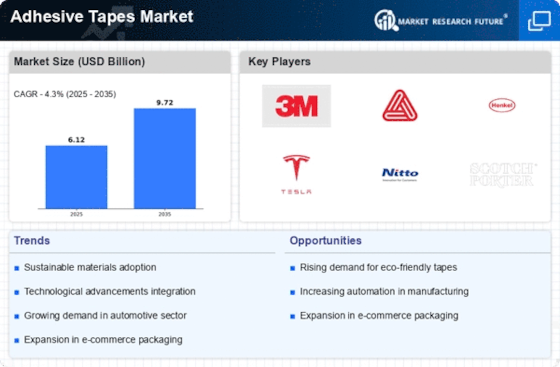

The adhesive tapes market is experiencing a notable surge in demand, particularly within the packaging sector. As e-commerce continues to expand, the need for efficient and reliable packaging solutions has become paramount. Adhesive tapes are increasingly utilized for sealing, bundling, and securing packages, which enhances the overall efficiency of logistics operations. Recent data indicates that the packaging segment accounts for a substantial share of the adhesive tapes market, driven by the growing preference for lightweight and cost-effective materials. This trend is likely to persist, as businesses seek to optimize their supply chains and reduce operational costs. Consequently, the adhesive tapes market is poised for growth, as manufacturers innovate to meet the evolving needs of the packaging sector.