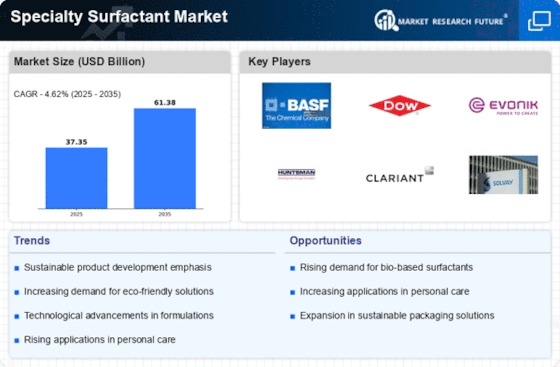

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the specialty surfactant market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, specialty surfactant industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the specialty surfactant industry to benefit clients and increase the market sector. In recent years, the specialty surfactant industry has offered some of the most significant advantages to market.

Major players in the specialty surfactant market attempting to increase market demand by investing in research and development operations include Akzo Nobel N.V. (Netherlands), Arkema (France), Ashland (US), BASF SE (Germany), Clariant (Switzerland), DowDuPont (US), Evonik Industries AG (Germany), GEO (US), Huntsman International LLC (US), Innospec (US), Libra Speciality Chemicals Limited (UK), Procter & Gamble (US), Pilot Chemical Corp. (US), and Stepan Company (US).

Fast-moving consumer items are manufactured and marketed by the Procter & Gamble Company (P&G). Conditioners, shampoo, razors for men and women, toothbrushes, toothpaste, dishwashing liquids, detergents, surface cleaners, and air fresheners are among the company's offerings. Additionally, it sells toilet paper, paper towels, tissues, diapers, and pants. Head & Shoulders, Olay, Pantene, Pampers, Gillette, Braun, Tide, Ariel, and Fusion are just a few of P&G's well-known brand names. The business sells its goods through a variety of outlets, including pharmacies, drugstores, department shops, high-frequency retailers, membership clubs, specialty beauty retailers, and grocery stores.

Specialty chemicals and cutting-edge materials are the focus of Arkema SA. The business provides solutions for adhesives, biobased materials, coatings, composites, health care, and sporting goods. Technical polymers, hydrogen peroxide, organic peroxides, thiochemicals, fluorogases, acrylics, photocure resins, filtration and adsorption, rheology additives, coating resins, and other products are among the company's offerings.

In May Golden Gate Capital, a private equity firm, sold ArrMaz, a Florida-based specialty surfactant company, to Arkema Company for $570 million. The acquisition, according to Arkema, will enable it to meet its goal of generating 80% of its income from specialty chemicals by 2023.