Rising Customer Expectations

In the P&C Insurance Software Market, rising customer expectations are reshaping the landscape. Consumers now demand personalized services, quick response times, and seamless digital interactions. This trend compels insurers to adopt advanced software solutions that can analyze customer data and provide tailored offerings. Research indicates that companies utilizing customer-centric software have seen a 25% increase in customer satisfaction scores. Consequently, insurers are prioritizing investments in technology that enhances user experience, thereby driving growth in the software market.

Emergence of Insurtech Startups

The emergence of insurtech startups is reshaping the P&C Insurance Software Market. These agile companies are introducing innovative solutions that challenge traditional insurance models. By leveraging technology, insurtech firms are able to offer more efficient and customer-friendly services. This trend is fostering competition and prompting established insurers to adopt new software solutions to keep pace. Data indicates that insurtech investments have surged, with funding reaching over 10 billion in the past year. Consequently, the presence of insurtech is driving advancements in software development and enhancing the overall market dynamics.

Integration of Advanced Analytics

The integration of advanced analytics into the P&C Insurance Software Market is becoming increasingly prevalent. Insurers are leveraging data analytics to gain insights into risk assessment, pricing strategies, and customer behavior. This analytical capability allows companies to make informed decisions and optimize their operations. Reports suggest that organizations employing advanced analytics have improved their underwriting accuracy by 20%, leading to better risk management. As a result, the demand for software that incorporates these analytical tools is expected to grow, driving innovation within the industry.

Regulatory Changes and Compliance Needs

The P&C Insurance Software Market is significantly influenced by evolving regulatory frameworks. Insurers are required to comply with a myriad of regulations that govern data protection, financial reporting, and consumer rights. This necessitates the implementation of robust software solutions that ensure compliance and mitigate risks. The market for compliance-related software is projected to grow by 15% annually as companies seek to avoid penalties and enhance their operational integrity. Thus, the demand for specialized software that addresses these regulatory challenges is on the rise.

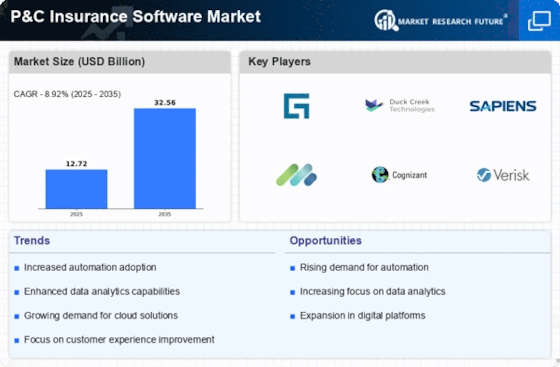

Increased Demand for Digital Transformation

The P&C Insurance Software Market is experiencing a notable surge in demand for digital transformation solutions. Insurers are increasingly recognizing the necessity of modernizing their operations to enhance efficiency and customer experience. This shift is driven by the need to streamline processes, reduce operational costs, and improve service delivery. According to recent data, the adoption of digital tools in the insurance sector has led to a 30% reduction in processing times for claims. As a result, companies are investing heavily in software solutions that facilitate automation and data analytics, thereby positioning themselves competitively in the market.