Expansion of 5G Infrastructure

The rollout of 5G infrastructure in Spain is a pivotal driver for the system on-chip market. As telecommunications companies invest heavily in 5G networks, the demand for advanced chips that support high-speed data transmission is increasing. The system on-chip market is responding by developing specialized components that can handle the unique requirements of 5G technology, such as low latency and high bandwidth. By 2025, the market for 5G-related chips is projected to grow by 30%, reflecting the urgency of this technological transition. This expansion not only enhances connectivity but also opens avenues for new applications in IoT, autonomous vehicles, and smart cities. The implications for the system on-chip market are profound, as companies strive to meet the evolving demands of a connected world.

Investment in Research and Development

Investment in research and development (R&D) is a critical driver for the system on-chip market in Spain. As companies seek to maintain a competitive edge, they are allocating substantial resources towards R&D initiatives aimed at developing next-generation chips. This focus on innovation is essential for addressing the increasing complexity of applications across various sectors, including automotive, healthcare, and industrial automation. In 2025, R&D spending in the semiconductor sector is projected to increase by 15%, reflecting the industry's commitment to advancing technology. The system on-chip market benefits from these investments, as they lead to breakthroughs in performance, efficiency, and functionality. This ongoing commitment to R&D is likely to foster a robust ecosystem that supports sustained growth and innovation in the market.

Growing Demand for Consumer Electronics

The system on-chip market in Spain is significantly driven by the increasing demand for consumer electronics. With the proliferation of smart devices, including smartphones, tablets, and wearables, the need for efficient and compact chips is paramount. In 2025, the consumer electronics segment is expected to represent around 40% of the total system on-chip market. This trend underscores the importance of integrating advanced functionalities into smaller form factors, which is essential for modern consumer preferences. The system on-chip market is adapting by focusing on miniaturization and energy efficiency, ensuring that devices can deliver high performance without compromising battery life. As consumer expectations continue to evolve, the market is likely to see sustained growth, driven by innovation in chip design.

Increased Adoption of AI and Machine Learning

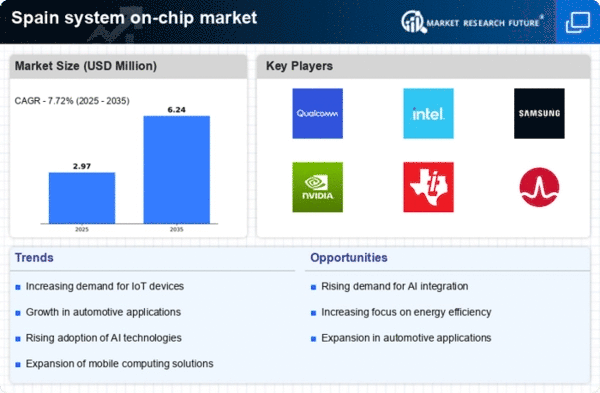

The integration of artificial intelligence (AI) and machine learning (ML) technologies is significantly influencing the system on-chip market in Spain. As industries increasingly adopt AI-driven solutions, the demand for specialized chips that can handle complex algorithms is on the rise. In 2025, it is estimated that the AI chip market will account for approximately 25% of the overall system on-chip market. This trend indicates a shift towards more intelligent systems capable of real-time data processing and decision-making. The system on-chip market is adapting to these needs by developing chips that optimize performance for AI applications, thereby enhancing capabilities in sectors such as healthcare, finance, and smart cities. This growing focus on AI integration is expected to propel the market forward, creating new opportunities for innovation.

Technological Advancements in Semiconductor Design

The system on-chip market in Spain is experiencing a surge due to rapid technological advancements in semiconductor design. Innovations such as 3D chip stacking and advanced lithography techniques are enhancing performance and reducing power consumption. This evolution is crucial as the demand for high-performance computing continues to rise, particularly in sectors like automotive and telecommunications. In 2025, the market is projected to reach €1.5 billion, reflecting a growth rate of approximately 10% annually. These advancements not only improve efficiency but also enable the integration of multiple functionalities into a single chip, which is essential for modern applications. As companies invest in research and development, the system on-chip market is likely to witness further enhancements, driving competitiveness and fostering new applications.