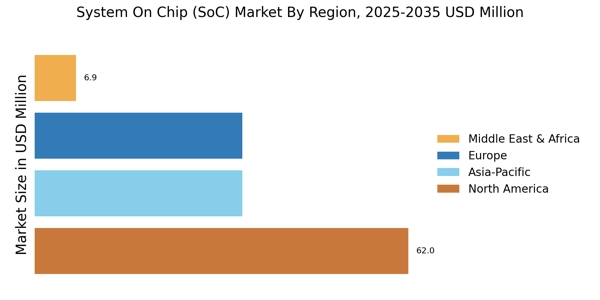

By Region, the study provides market insights into North America, Europe, Asia-Pacific and the Rest of the World. Asia Pacific System On Chip (SoC) market accounted for USD 48.70 billion in 2021 and is expected to exhibit a significant CAGR growth during the study period. Asia Pacific's system-on-chip market is set to pick up steam propelled by the growing demand for IoT-based consumer electronic products, such as smart T.V., wearables, and mobiles in countries like India and China. This results from rising consumer appliance demand, and rising consumer interest in electronic gadgets is expected to drive market growth.

Throughout the projection period, it is expected that the Asia Pacific region will account for a sizeable percentage of the global System on Chip Market due to the increasing demand for System on Chip Market in the consumer electronics, I.T., and telecommunications industries. Systems on Chips are frequently used in electronic devices in the Region, including Bluetooth headsets, fitness bands, tablets, smartwatches, laptops, home appliances, and consumer electronics. The market is also benefiting from increased digitization, the Internet of Things (IoT) growth, analytics and server performance improvements, and ongoing investments in potent workstations and servers that employ 5G technologies.

Further, the major countries studied in the market report are The U.S., Canada, Germany, France, the U.K., Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

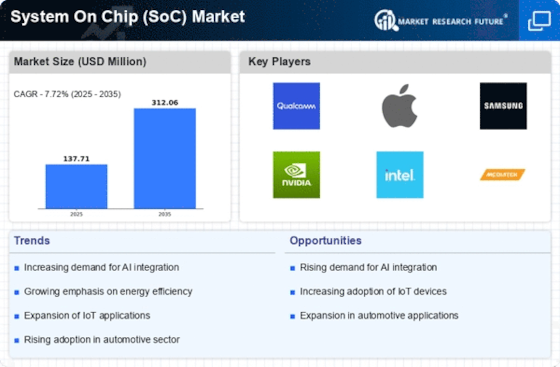

North America has the largest market share for systems on a chip. Large telecom and I.T. companies like Qualcomm and Apple are a couple of the reasons behind this. Modern electrical items are still in great demand in this area. This is further supported by the fact that IoT devices are gaining popularity, especially in North America. In North America, the industry is anticipated to grow rapidly. The United States and Canada are North America's two most populous countries.

This is due to the increasing usage of IoT integration with household appliances, which is predicted to gain popularity throughout the projected period.

With a revenue share of 22.2% in 2021, Europe is regarded as the Region with the most attractive market for systems on chips after the Asia Pacific. The existence of highly industrialized nations like Germany, the U.K., France, Italy, and Belgium is largely responsible for the market expansion in this area. Government programs that promote the development of these businesses are also a major factor in the expansion of the market. Additionally, the U.K. System On Chip (SoC) market grew the quickest in the European area, while the System On Chip (SoC) market in Germany had the biggest market share.