Regulatory Compliance and Standards

Regulatory compliance is a critical factor influencing the outsourced software-testing market. In Spain, businesses are required to adhere to various industry standards and regulations, particularly in sectors such as finance and healthcare. This necessity drives companies to seek external testing services that can ensure compliance with these stringent requirements. The outsourced software-testing market is likely to benefit from this trend, as organizations prioritize risk management and compliance in their software development processes. By outsourcing testing, companies can leverage the expertise of specialized providers who are well-versed in regulatory standards, thereby mitigating risks associated with non-compliance.

Rising Demand for Quality Assurance

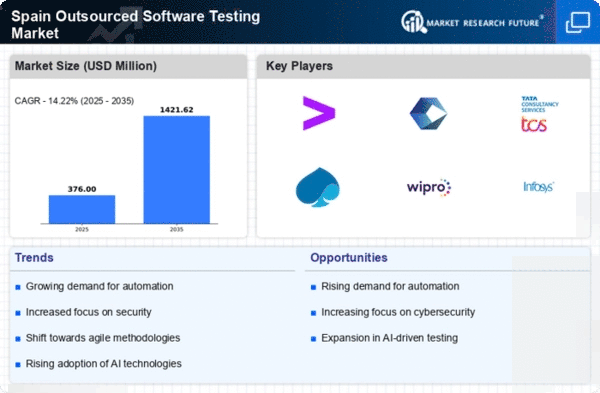

The increasing complexity of software applications has led to a heightened demand for quality assurance in the outsourced software-testing market. Companies in Spain are recognizing that robust testing processes are essential to ensure software reliability and performance. As a result, the market is projected to grow at a CAGR of approximately 12% over the next five years. This growth is driven by the need for businesses to deliver high-quality products to remain competitive. Furthermore, the emphasis on user experience has prompted organizations to invest more in testing services, thereby expanding the outsourced software-testing market. The focus on quality assurance is not merely a trend but a necessity for companies aiming to enhance customer satisfaction and loyalty.

Cost Efficiency and Resource Optimization

Cost efficiency remains a pivotal driver in the outsourced software-testing market. By outsourcing testing functions, companies in Spain can significantly reduce operational costs, allowing them to allocate resources more effectively. This approach enables organizations to focus on their core competencies while leveraging specialized testing services. Reports indicate that businesses can save up to 30% on testing costs by outsourcing. The financial benefits are compelling, as firms can achieve high-quality testing without the overhead associated with maintaining in-house teams. This trend is likely to continue, as more companies seek to optimize their budgets and improve their return on investment in software development.

Growing Focus on Agile and DevOps Practices

The shift towards Agile and DevOps methodologies is significantly impacting the outsourced software-testing market. In Spain, organizations are increasingly adopting these practices to enhance collaboration and accelerate software delivery. This transition necessitates a more integrated approach to testing, where outsourced services play a vital role. The demand for continuous testing and feedback loops is driving companies to seek external expertise that can align with their Agile and DevOps initiatives. As a result, the outsourced software-testing market is expected to expand, as businesses recognize the value of agile testing strategies in improving overall software quality and responsiveness to market changes.

Technological Advancements in Testing Tools

Technological advancements are reshaping the landscape of the outsourced software-testing market. The introduction of sophisticated testing tools and frameworks has enhanced the efficiency and effectiveness of testing processes. In Spain, the adoption of AI and machine learning in testing is becoming increasingly prevalent, allowing for more accurate and faster testing cycles. These innovations not only improve the quality of software but also reduce time-to-market, which is crucial in today's fast-paced environment. As organizations strive to keep up with technological changes, the demand for advanced testing solutions is expected to rise, further propelling the growth of the outsourced software-testing market.