Cost Efficiency

Cost efficiency remains a pivotal driver for the ip telephony market in Spain. Businesses are increasingly seeking ways to reduce operational expenses, and ip telephony solutions offer a compelling alternative to traditional telephony systems. By leveraging internet-based communication, organizations can significantly lower their telecommunication costs, with estimates suggesting savings of up to 50% on long-distance calls. Additionally, the reduction in hardware and maintenance costs associated with ip telephony systems further enhances their appeal. As companies continue to navigate economic challenges, the emphasis on cost-effective communication solutions is likely to propel the growth of the ip telephony market. This trend indicates a shift towards more sustainable business practices, where organizations prioritize investments that yield long-term financial benefits.

Increased Remote Work

The rise of remote work has fundamentally altered the landscape of the ip telephony market in Spain. As organizations adapt to flexible work arrangements, the demand for reliable and efficient communication tools has surged. The ip telephony market is well-positioned to meet this need, providing solutions that facilitate seamless communication among remote teams. In 2025, it is projected that over 60% of companies in Spain will implement hybrid work models, further driving the adoption of ip telephony services. This shift not only enhances collaboration but also allows businesses to maintain productivity regardless of location. Consequently, the ip telephony market is expected to grow as organizations invest in technologies that support remote work and enhance connectivity..

Technological Advancements

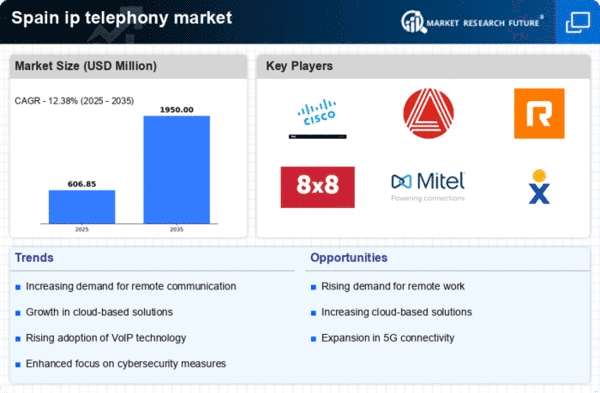

The rapid evolution of technology plays a crucial role in shaping the ip telephony market in Spain. Innovations such as Voice over Internet Protocol (VoIP) and Unified Communications (UC) systems have transformed traditional communication methods. As businesses increasingly adopt these technologies, the demand for efficient and cost-effective communication solutions rises. In 2025, it is estimated that the adoption of VoIP services in Spain will reach approximately 70%, indicating a significant shift from conventional telephony. This trend suggests that organizations are prioritizing flexibility and scalability, which are essential in today's dynamic business environment. Furthermore, advancements in network infrastructure, including the rollout of 5G technology, are likely to enhance the quality and reliability of ip telephony services, thereby driving market growth.

Growing Demand for Mobility

The growing demand for mobility is a key factor influencing the ip telephony market in Spain. As mobile devices become ubiquitous, employees increasingly expect to communicate and collaborate from anywhere, at any time. The ip telephony market is responding to this demand by offering mobile-friendly solutions that enable users to access communication tools on their smartphones and tablets. In 2025, it is projected that mobile usage for ip telephony services will account for approximately 55% of total usage in Spain. This trend suggests that businesses must adapt to the evolving preferences of their workforce, ensuring that communication solutions are accessible and user-friendly. As a result, the ip telephony market is likely to witness continued growth as organizations invest in mobile capabilities to enhance employee engagement and productivity.

Integration with Business Applications

The integration of ip telephony solutions with various business applications is emerging as a significant driver in Spain's ip telephony market. As organizations seek to streamline operations and improve efficiency, the ability to connect communication tools with customer relationship management (CRM) systems, project management software, and other applications becomes increasingly valuable. This integration allows for enhanced data sharing and collaboration, ultimately leading to improved customer service and operational effectiveness. In 2025, it is anticipated that around 40% of businesses in Spain will prioritize the integration of ip telephony with their existing software ecosystems. This trend indicates a growing recognition of the importance of cohesive communication strategies in driving business success.