Cost Efficiency and Scalability

Cost efficiency remains a primary driver for the adoption of IP Telephony and Unified Communications as a Service Market solutions. Businesses are increasingly recognizing the financial benefits of transitioning from traditional telephony systems to cloud-based services. By leveraging these solutions, organizations can reduce operational costs associated with hardware maintenance and upgrades. Additionally, the scalability of these services allows companies to adjust their communication needs based on growth or changes in workforce size. This flexibility is particularly appealing to small and medium-sized enterprises, which may have limited budgets. As a result, the IP Telephony and Unified Communications as a Service Market is likely to see continued growth as more businesses seek cost-effective communication solutions.

Increased Focus on Customer Experience

Enhancing customer experience is becoming a priority for many organizations, driving the demand for IP Telephony and Unified Communications as a Service Market solutions. Companies are recognizing that effective communication tools can significantly impact customer satisfaction and retention. By utilizing unified communication platforms, businesses can streamline interactions with customers, providing timely responses and personalized service. Data suggests that organizations that invest in advanced communication technologies can improve customer engagement metrics by up to 30%. This focus on customer experience is likely to propel the growth of the IP Telephony and Unified Communications as a Service Market as companies strive to differentiate themselves in competitive markets.

Growing Demand for Remote Work Solutions

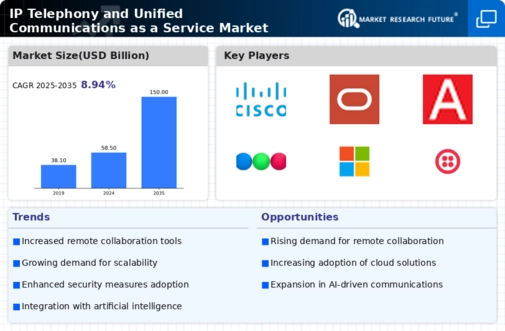

The rise in remote work has led to an increased demand for IP Telephony and Unified Communications as a Service Market solutions. Organizations are seeking reliable communication tools that facilitate collaboration among distributed teams. According to recent data, the market for remote work solutions is projected to grow at a compound annual growth rate of over 20% in the coming years. This trend indicates that businesses are prioritizing flexible communication systems that can support remote operations. As a result, the IP Telephony and Unified Communications as a Service Market is likely to experience significant growth, driven by the need for seamless connectivity and collaboration tools that enhance productivity in a remote work environment.

Regulatory Compliance and Security Concerns

As businesses increasingly rely on digital communication, regulatory compliance and security concerns are becoming paramount in the IP Telephony and Unified Communications as a Service Market. Organizations must adhere to various regulations regarding data protection and privacy, which necessitates the implementation of secure communication solutions. The demand for services that offer robust security features, such as encryption and secure access controls, is on the rise. Furthermore, companies are seeking solutions that can help them comply with industry-specific regulations, which can vary significantly across sectors. This heightened focus on security and compliance is likely to drive growth in the IP Telephony and Unified Communications as a Service Market, as organizations prioritize safeguarding their communications.

Advancements in Technology and Infrastructure

Technological advancements play a crucial role in shaping the IP Telephony and Unified Communications as a Service Market. The proliferation of high-speed internet and the expansion of 5G networks are enabling more robust and reliable communication solutions. These advancements allow for improved voice quality, reduced latency, and enhanced user experiences. Furthermore, the integration of advanced features such as video conferencing, instant messaging, and file sharing into unified communication platforms is becoming increasingly common. As organizations invest in modern infrastructure, the demand for IP Telephony and Unified Communications as a Service Market solutions is expected to rise, reflecting a shift towards more sophisticated communication technologies.

Leave a Comment