Rising Air Travel Demand

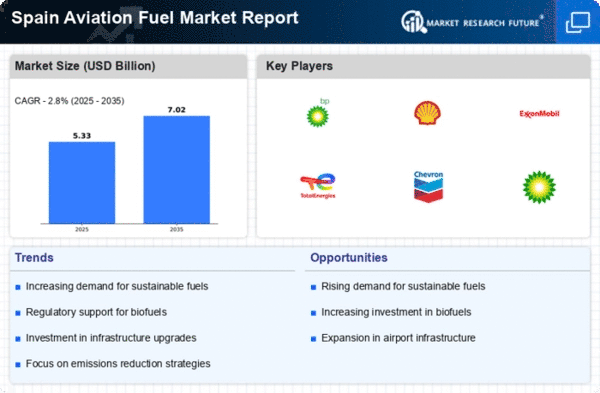

The aviation fuel market in Spain is experiencing a notable surge in demand due to the increasing number of air travelers. In recent years, the number of passengers has risen significantly, with estimates indicating a growth of approximately 5% annually. This trend is likely to continue as Spain remains a popular tourist destination, attracting millions of visitors each year. Consequently, the aviation fuel market is poised to benefit from this heightened demand, necessitating a corresponding increase in fuel supply. Airlines are expected to ramp up operations, which will further drive the need for aviation fuel. This growing demand may also lead to competitive pricing strategies among fuel suppliers, impacting overall market dynamics. As the aviation sector expands, the aviation fuel market must adapt to meet the evolving needs of airlines and passengers alike.

Competitive Pricing Strategies

The aviation fuel market in Spain is characterized by competitive pricing strategies among suppliers, driven by the need to attract and retain airline customers. With multiple players in the market, fuel prices are subject to fluctuations based on supply and demand dynamics. Recent data indicates that fuel prices have varied by as much as 10% over the past year, reflecting changes in The aviation fuel market conditions. This competitive landscape compels suppliers to adopt pricing strategies that not only ensure profitability but also provide value to airlines. As airlines seek to manage operational costs, they may favor suppliers offering more favorable pricing terms. Consequently, the aviation fuel market must navigate these pricing pressures while maintaining service quality and reliability, which are critical for sustaining long-term relationships with airline clients.

Focus on Environmental Regulations

The aviation fuel market in Spain is increasingly influenced by stringent environmental regulations aimed at reducing carbon emissions. The European Union has set ambitious targets for carbon neutrality by 2050, which compels the aviation sector to adopt cleaner fuel alternatives. As a result, the aviation fuel market is witnessing a shift towards more sustainable fuel options, including biofuels and synthetic fuels. Compliance with these regulations may require significant investment from fuel suppliers, as they adapt their offerings to meet new standards. This regulatory landscape could potentially reshape the competitive dynamics within the aviation fuel market, as companies that proactively embrace sustainable practices may gain a competitive edge. The ongoing evolution of environmental policies is likely to drive innovation and investment in cleaner fuel technologies, further impacting the market.

Investment in Infrastructure Development

Infrastructure development plays a crucial role in shaping the aviation fuel market in Spain. The government has been investing heavily in upgrading airports and fuel supply facilities to accommodate the increasing air traffic. Recent reports suggest that over €1 billion has been allocated for infrastructure improvements in major airports, which is expected to enhance fuel distribution efficiency. This investment not only supports the operational capabilities of airlines but also ensures that the aviation fuel market can meet the growing demand for fuel. Enhanced infrastructure may lead to reduced turnaround times for refueling, thereby improving overall operational efficiency for airlines. Furthermore, the development of new fuel storage facilities is likely to bolster supply chain resilience, ensuring that the aviation fuel market can respond effectively to fluctuations in demand.

Technological Innovations in Fuel Supply

Technological advancements are playing a pivotal role in transforming the aviation fuel market in Spain. Innovations in fuel management systems and logistics are enhancing the efficiency of fuel supply chains. For instance, the implementation of advanced tracking and monitoring technologies allows for real-time data analysis, optimizing fuel distribution processes. This not only reduces operational costs but also minimizes waste, contributing to a more sustainable aviation fuel market. Furthermore, the integration of automation in refueling operations is expected to streamline processes, thereby improving turnaround times for aircraft. As technology continues to evolve, the aviation fuel market is likely to see increased investment in digital solutions that enhance operational efficiency and reduce environmental impact.