Corporate Sustainability Initiatives

Many corporations are adopting sustainability initiatives that prioritize environmental responsibility, significantly impacting the sustainable aviation-fuel market. Major airlines are committing to net-zero emissions by 2050, which necessitates a shift towards sustainable fuels. This commitment is reflected in the increasing number of partnerships between airlines and sustainable fuel producers. For example, in 2025, several airlines have pledged to utilize sustainable aviation fuel for at least 10% of their total fuel consumption. This trend not only enhances corporate image but also aligns with consumer preferences for environmentally friendly practices, thereby propelling the sustainable aviation-fuel market forward.

Increasing Environmental Regulations

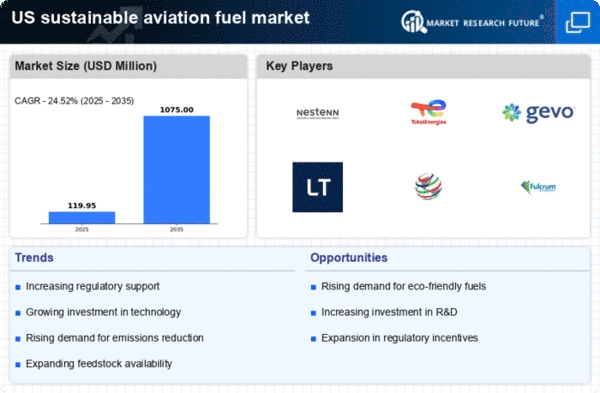

The sustainable aviation-fuel market is experiencing a surge in demand due to increasing environmental regulations imposed by federal and state authorities. These regulations aim to reduce greenhouse gas emissions and promote cleaner energy sources. For instance, the Environmental Protection Agency (EPA) has set ambitious targets for reducing aviation emissions, which has led airlines to seek alternative fuels. The sustainable aviation-fuel market is projected to grow as airlines strive to comply with these regulations, potentially reaching a market value of $15 billion by 2030. This regulatory landscape encourages investment in sustainable fuel technologies, thereby driving innovation and adoption within the industry.

Government Funding and Research Initiatives

Government funding and research initiatives are vital drivers of the sustainable aviation-fuel market. Federal and state governments are investing in research programs aimed at developing advanced sustainable fuel technologies. For instance, the U.S. Department of Energy has allocated millions of dollars to support research in biofuels and alternative energy sources. This funding not only accelerates technological advancements but also fosters collaboration between public and private sectors. As a result, the sustainable aviation-fuel market is likely to benefit from increased innovation and reduced costs, making sustainable fuels more competitive with traditional aviation fuels.

Technological Innovations in Fuel Production

Technological advancements in the production of sustainable aviation fuels are playing a crucial role in shaping the market. Innovations such as the development of advanced biofuels and synthetic fuels are making sustainable aviation fuel more accessible and cost-effective. The sustainable aviation-fuel market is likely to benefit from these innovations, as they can reduce production costs by up to 30% compared to traditional methods. Furthermore, the integration of carbon capture technologies in fuel production processes may enhance sustainability, attracting more investments into the sector. As these technologies mature, they are expected to significantly increase the availability of sustainable aviation fuels.

Consumer Demand for Sustainable Travel Options

There is a growing consumer demand for sustainable travel options, which is influencing the sustainable aviation-fuel market. Travelers are increasingly prioritizing eco-friendly choices, prompting airlines to respond by investing in sustainable aviation fuels. Surveys indicate that over 70% of travelers are willing to pay a premium for flights that utilize sustainable fuels. This shift in consumer behavior is encouraging airlines to incorporate sustainable aviation fuels into their operations, thereby expanding the market. As airlines strive to meet this demand, the sustainable aviation-fuel market is expected to see substantial growth, potentially doubling in size by 2030.