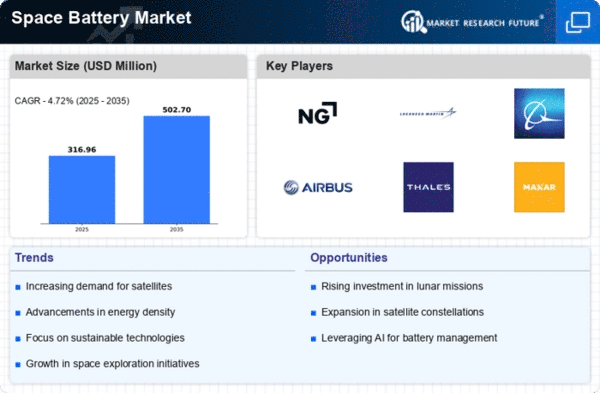

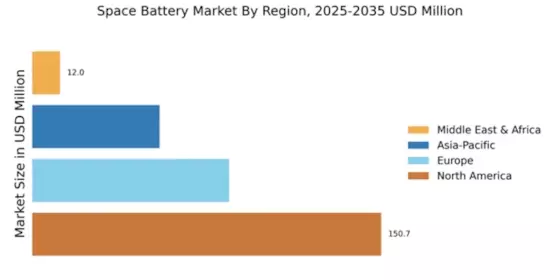

North America : Innovation Hub for Space Batteries

North America dominates the space battery market, holding a significant share of 150.67M in 2024. The region's growth is driven by increasing investments in space exploration and satellite technology, alongside supportive government policies. The demand for advanced energy storage solutions is further fueled by the rise of commercial space ventures and the need for sustainable energy sources in space missions. Regulatory frameworks are evolving to support innovation and safety in space technologies.

The competitive landscape in North America is robust, featuring key players such as Northrop Grumman, Lockheed Martin, and Boeing. These companies are at the forefront of developing cutting-edge battery technologies tailored for space applications. The presence of leading aerospace firms and a strong supply chain ecosystem enhances the region's capability to meet the growing demand for space batteries, ensuring its position as a global leader in this sector.

Europe : Emerging Powerhouse in Space Tech

Europe's space battery market is on the rise, with a market size of 85.0M in 2024. The region benefits from strong governmental support for space initiatives, including the European Space Agency's programs aimed at enhancing satellite capabilities. The increasing focus on sustainability and renewable energy sources in space missions is driving demand for advanced battery technologies. Regulatory frameworks are being established to ensure safety and efficiency in space operations, fostering innovation in the sector.

Leading countries in Europe, such as France and Germany, are home to major players like Airbus and Thales Group, which are pivotal in the development of space battery technologies. The competitive landscape is characterized by collaborations between private companies and governmental agencies, enhancing research and development efforts. This synergy is crucial for advancing battery technologies that meet the specific needs of space missions, positioning Europe as a formidable player in the global market.

Asia-Pacific : Emerging Market for Space Batteries

The Asia-Pacific region is witnessing a burgeoning space battery market, valued at 55.0M in 2024. This growth is driven by increasing investments in space exploration and satellite technology, particularly in countries like Japan and South Korea. The demand for reliable and efficient energy storage solutions is rising as nations aim to enhance their space capabilities. Regulatory bodies are beginning to establish frameworks to support the development of advanced battery technologies for space applications.

Japan and South Korea are leading the charge in the Asia-Pacific space battery market, with companies like Panasonic and LG Energy Solution making significant contributions. The competitive landscape is evolving, with a focus on innovation and collaboration among local firms and international partners. This dynamic environment is essential for meeting the growing demand for space batteries, ensuring that the region plays a vital role in the global market.

Middle East and Africa : Resource-Rich Frontier for Innovation

The Middle East and Africa region is emerging as a new frontier in the space battery market, with a market size of 12.0M in 2024. The growth is primarily driven by increasing interest in space exploration and satellite technology, supported by government initiatives aimed at enhancing regional capabilities. The demand for innovative energy solutions is rising as countries seek to establish a presence in the global space sector. Regulatory frameworks are being developed to facilitate investment and innovation in space technologies.

Countries like the UAE are taking the lead in the region, with significant investments in space programs and partnerships with global aerospace firms. The competitive landscape is characterized by a growing number of startups and collaborations aimed at advancing battery technologies. This emerging ecosystem is crucial for fostering innovation and meeting the specific energy needs of space missions, positioning the region as a potential player in the global market.