Integration of Smart Home Ecosystems

The integration of smart home ecosystems serves as a vital driver for the smart home-appliances market in South Korea. Consumers are increasingly drawn to interconnected devices that can communicate and operate seamlessly together. This trend is exemplified by the rise of smart hubs that allow users to control various appliances from a single interface. The market for smart home ecosystems is projected to grow by approximately 25% in the next few years, as consumers seek cohesive solutions that enhance convenience and efficiency. This integration fosters a more user-friendly experience, thereby driving the expansion of the smart home-appliances market.

Rising Consumer Demand for Convenience

The smart home-appliances market in South Korea experiences a notable surge in consumer demand for convenience-driven solutions. As lifestyles become increasingly hectic, consumers seek appliances that simplify daily tasks. This trend is reflected in the growing adoption of smart kitchen devices, such as automated cooking systems and smart refrigerators, which enhance efficiency. According to recent data, the market for smart kitchen appliances is projected to grow by approximately 15% annually, indicating a robust appetite for innovative solutions. This rising demand for convenience is a key driver, as consumers prioritize products that save time and effort, thereby propelling the smart home-appliances market forward.

Sustainability and Eco-Friendly Products

Sustainability emerges as a significant driver in the smart home-appliances market in South Korea. Consumers are increasingly aware of environmental issues and are seeking eco-friendly appliances that reduce energy consumption and minimize waste. Smart appliances equipped with energy-saving features, such as smart washing machines that optimize water usage, are gaining traction. Data suggests that the market for energy-efficient appliances is expected to expand by 18% over the next few years, as consumers prioritize sustainability in their purchasing choices. This shift towards eco-friendly products not only aligns with consumer values but also propels the growth of the smart home-appliances market.

Increased Focus on Home Security Solutions

The smart home-appliances market in South Korea is significantly influenced by the heightened focus on home security solutions. With rising concerns about safety, consumers are increasingly investing in smart security systems, including surveillance cameras and smart locks. These devices not only provide real-time monitoring but also offer remote access features, allowing homeowners to manage security from anywhere. Recent statistics indicate that the market for smart security appliances is anticipated to grow by 20% in the coming years, reflecting the urgent need for enhanced home protection. This growing emphasis on security is a crucial driver for the smart home-appliances market, as consumers prioritize safety in their purchasing decisions.

Technological Advancements in Smart Appliances

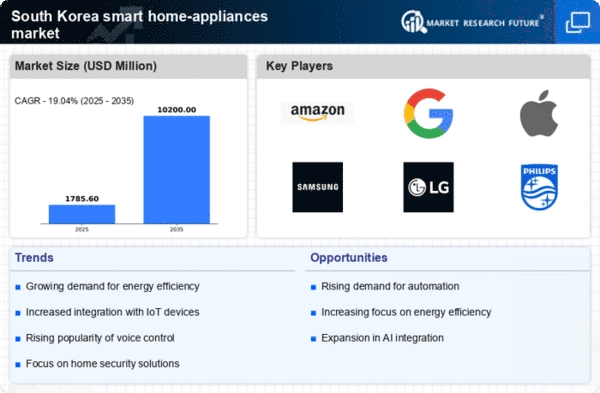

Technological advancements play a pivotal role in shaping the smart home-appliances market in South Korea. Innovations in connectivity, such as enhanced Wi-Fi and Bluetooth capabilities, enable seamless integration of devices within the home ecosystem. Furthermore, the introduction of machine learning algorithms allows appliances to learn user preferences, optimizing their functionality. For instance, smart thermostats can adjust temperatures based on user behavior, leading to improved energy efficiency. The market is expected to witness a compound annual growth rate (CAGR) of around 12% over the next five years, driven by these technological advancements that enhance user experience and appliance performance.