Aging Population

Japan's aging population significantly influences the smart home-appliances market. With a growing number of elderly individuals, there is an increasing demand for appliances that enhance safety and convenience. Smart home technologies, such as automated lighting and health monitoring systems, cater to the needs of seniors, allowing them to live independently while ensuring their safety. In 2025, it is estimated that over 28% of Japan's population will be aged 65 and older, creating a substantial market for products designed specifically for this demographic. This trend suggests that manufacturers may focus on developing user-friendly interfaces and features that address the unique challenges faced by older adults, thereby expanding the smart home-appliances market.

Growing Urbanization

The rapid urbanization in Japan is a pivotal driver for the smart home-appliances market. As more individuals migrate to urban areas, the demand for efficient and space-saving appliances increases. Urban dwellers often seek solutions that enhance convenience and optimize living spaces. In 2025, approximately 91% of Japan's population resides in urban areas, which propels the need for smart appliances that can be integrated into compact living environments. This trend indicates a shift towards multifunctional devices that cater to the needs of city residents, thereby expanding the smart home-appliances market. Furthermore, urbanization is associated with a higher disposable income, allowing consumers to invest in advanced technologies that improve their quality of life.

Environmental Awareness

Environmental awareness among Japanese consumers is a significant driver for the smart home-appliances market. As sustainability becomes a priority, individuals are increasingly seeking energy-efficient appliances that reduce their carbon footprint. The government has implemented various initiatives to promote energy conservation, which aligns with the growing consumer preference for eco-friendly products. In 2025, it is projected that energy-efficient appliances will account for over 40% of the smart home-appliances market. This shift indicates that manufacturers are likely to invest in developing products that not only meet energy standards but also appeal to environmentally conscious consumers. Consequently, the market is expected to witness a surge in demand for smart appliances that offer both functionality and sustainability.

Rising Disposable Income

The rise in disposable income among Japanese households is a key driver for the smart home-appliances market. As economic conditions improve, consumers are more willing to invest in advanced technologies that enhance their living standards. In 2025, the average disposable income in Japan is projected to increase by 3%, leading to greater spending on smart home devices. This trend suggests that consumers are prioritizing convenience and efficiency, opting for appliances that simplify daily tasks. Additionally, the availability of financing options and attractive pricing strategies may further encourage adoption. As a result, the smart home-appliances market is likely to experience robust growth, driven by the increasing purchasing power of consumers.

Technological Advancements

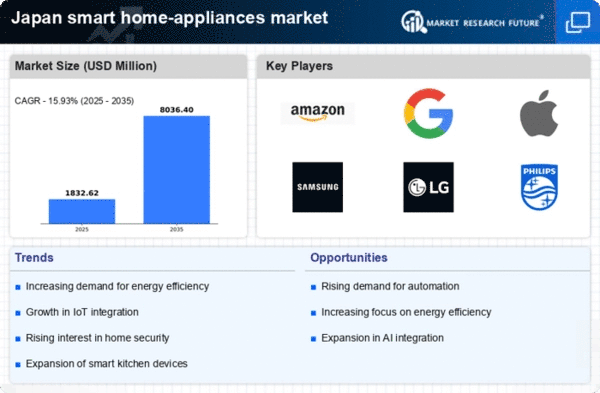

Technological advancements play a crucial role in shaping the smart home-appliances market. Innovations in artificial intelligence (AI), machine learning, and connectivity are driving the development of smarter appliances. In Japan, the integration of AI into home devices enhances user experience by enabling predictive maintenance and personalized settings. For instance, smart refrigerators can monitor food inventory and suggest recipes, while smart thermostats optimize energy consumption based on user behavior. The market is projected to grow at a CAGR of 15% from 2025 to 2030, reflecting the increasing adoption of these technologies. As consumers become more tech-savvy, the demand for appliances that offer seamless connectivity and automation is likely to rise, further propelling the market.