Rising Demand for Pipeline Integrity

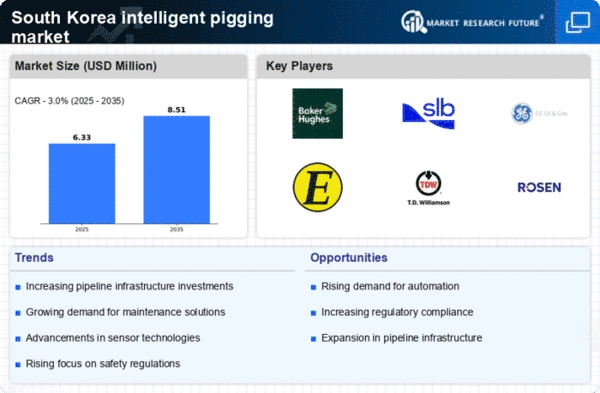

The increasing focus on maintaining pipeline integrity is a crucial driver for the intelligent pigging market. In South Korea, the oil and gas sector is experiencing heightened scrutiny regarding the safety and reliability of its infrastructure. This has led to a growing demand for intelligent pigging solutions, which can effectively detect anomalies and assess the condition of pipelines. The market is projected to grow at a CAGR of approximately 8% from 2025 to 2030, driven by the need for enhanced monitoring and maintenance practices. As companies seek to minimize downtime and prevent costly leaks, the intelligent pigging market is positioned to benefit significantly from this trend.

Investment in Infrastructure Development

South Korea's ongoing investment in infrastructure development plays a pivotal role in driving the intelligent pigging market. The government has allocated substantial budgets for upgrading and expanding pipeline networks, particularly in the energy sector. This investment is expected to reach approximately $10 billion by 2027, creating a favorable environment for intelligent pigging technologies. As new pipelines are constructed and existing ones are retrofitted, the demand for advanced inspection solutions will likely increase. The intelligent pigging market stands to gain from these developments, as operators seek to ensure the integrity and efficiency of their assets.

Growing Awareness of Environmental Impact

The rising awareness of environmental issues is influencing the intelligent pigging market in South Korea. Companies are increasingly recognizing the importance of minimizing their ecological footprint and adhering to environmental regulations. This shift in mindset is driving the adoption of intelligent pigging technologies, which can help detect leaks and reduce emissions. The intelligent pigging market is likely to see a surge in demand as organizations strive to implement sustainable practices. With the South Korean government promoting green initiatives, the market could experience growth as firms invest in technologies that align with these objectives.

Increased Regulatory Pressure on Safety Standards

In South Korea, increased regulatory pressure on safety standards is a significant driver for the intelligent pigging market. Regulatory bodies are implementing stricter guidelines to ensure the safety and reliability of pipeline operations. This has prompted companies to invest in intelligent pigging solutions that can provide comprehensive assessments of pipeline conditions. The intelligent pigging market is likely to see growth as organizations strive to comply with these regulations and avoid penalties. As safety becomes a top priority, the demand for advanced inspection technologies will continue to rise, further propelling the market forward.

Technological Innovations in Inspection Techniques

Technological innovations are transforming the inspection techniques used in the intelligent pigging market. In South Korea, advancements in sensor technology, data analytics, and artificial intelligence are enhancing the capabilities of intelligent pigging systems. These innovations allow for more accurate and efficient inspections, leading to improved decision-making and reduced operational costs. The intelligent pigging market is expected to benefit from these developments, as companies seek to leverage cutting-edge technologies to optimize their pipeline management. As the demand for real-time data and predictive maintenance grows, the market is likely to expand in response.