Growing Environmental Regulations

The tightening of environmental regulations in Germany is a pivotal factor driving the intelligent pigging market. Regulatory bodies are increasingly mandating stringent compliance measures for pipeline operators to minimize environmental risks associated with leaks and spills. The intelligent pigging market is adapting to these regulations by developing advanced inspection technologies that ensure compliance and enhance environmental safety. As of 2025, it is estimated that compliance-related expenditures for pipeline operators in Germany will exceed €1 billion annually. This regulatory landscape is likely to create a robust demand for intelligent pigging solutions, as companies strive to meet legal requirements while maintaining operational integrity.

Rising Demand for Pipeline Integrity

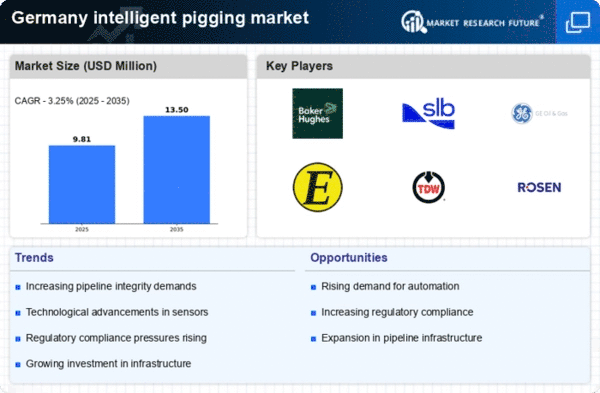

The increasing emphasis on pipeline integrity in Germany is a crucial driver for the intelligent pigging market. As industries such as oil and gas, water, and chemicals expand, the need for maintaining pipeline safety and efficiency becomes paramount. The intelligent pigging market is witnessing a surge in demand for advanced inspection technologies that can detect anomalies, corrosion, and blockages. According to recent data, the pipeline integrity management market in Germany is projected to grow at a CAGR of 6.5% from 2025 to 2030. This growth is indicative of the rising investments in intelligent pigging solutions, which are essential for ensuring the longevity and reliability of pipeline systems.

Investment in Infrastructure Development

Germany's ongoing investment in infrastructure development significantly influences the intelligent pigging market. The government has allocated substantial funds for upgrading and maintaining existing pipeline networks, particularly in urban areas. This investment is expected to reach approximately €10 billion by 2027, focusing on enhancing the safety and efficiency of pipeline operations. The intelligent pigging market stands to benefit from these initiatives, as advanced pigging technologies are integral to assessing the condition of aging pipelines. Furthermore, the integration of intelligent pigging solutions into new infrastructure projects is likely to become a standard practice, thereby driving market growth.

Increased Focus on Operational Efficiency

The pursuit of operational efficiency among German industries is a significant driver for the intelligent pigging market. Companies are increasingly adopting intelligent pigging technologies to optimize their pipeline operations, reduce downtime, and minimize maintenance costs. The intelligent pigging market is responding to this trend by offering innovative solutions that provide real-time data and analytics, enabling operators to make informed decisions. A recent survey indicated that 75% of pipeline operators in Germany are prioritizing investments in technologies that enhance operational efficiency. This shift is likely to propel the demand for intelligent pigging services, as organizations seek to streamline their processes and improve overall productivity.

Technological Innovations in Inspection Techniques

Technological innovations in inspection techniques are reshaping the landscape of the intelligent pigging market. The introduction of advanced sensors, robotics, and data analytics is enhancing the capabilities of intelligent pigging systems. In Germany, the market is witnessing a shift towards more sophisticated inspection methods that provide higher accuracy and reliability. The intelligent pigging market is expected to see a growth rate of 8% annually, driven by these technological advancements. Companies are increasingly investing in research and development to create next-generation pigging solutions that can address complex pipeline challenges. This trend indicates a promising future for the intelligent pigging market as it evolves to meet the demands of modern infrastructure.