Culinary Traditions and Innovations

Culinary traditions in South Korea, combined with modern innovations, are driving the fermentation ingredients market. Traditional fermented foods, such as kimchi and doenjang, are integral to South Korean cuisine, fostering a strong cultural connection to fermentation. However, there is also a growing trend towards fusion cuisine, where traditional fermentation techniques are applied to new ingredients and recipes. This blending of old and new is likely to create demand for diverse fermentation ingredients, as chefs and food manufacturers experiment with flavors and textures. The fermentation ingredients market is thus positioned to benefit from this culinary evolution, as it encourages the exploration of unique fermented products that appeal to both local and international consumers.

Health Consciousness Among Consumers

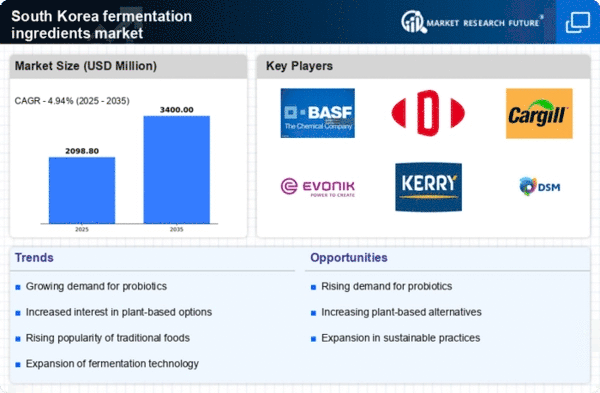

The increasing health consciousness among consumers in South Korea appears to be a pivotal driver for the fermentation ingredients market. As individuals become more aware of the benefits associated with fermented foods, such as improved gut health and enhanced immunity, the demand for natural fermentation ingredients is likely to rise. Reports indicate that the market for probiotics, a key segment within fermentation ingredients, is projected to grow at a CAGR of approximately 8% over the next five years. This trend suggests that consumers are actively seeking products that incorporate fermentation ingredients, thereby influencing manufacturers to innovate and expand their offerings. The fermentation ingredients market is thus positioned to benefit from this shift towards healthier dietary choices, as consumers increasingly prioritize functional foods that contribute to overall well-being.

Rising Popularity of Plant-Based Diets

The rising popularity of plant-based diets in South Korea is emerging as a significant driver for the fermentation ingredients market. As more consumers adopt vegetarian and vegan lifestyles, the demand for plant-based fermentation ingredients is likely to increase. This shift is reflected in the growing interest in fermented plant-based products, such as tempeh and kimchi, which are rich in probiotics and nutrients. Market analysis suggests that the plant-based food sector is expected to grow by approximately 10% annually, indicating a robust opportunity for fermentation ingredient suppliers. The fermentation ingredients market stands to gain from this trend, as manufacturers seek to develop innovative plant-based products that cater to the evolving dietary preferences of consumers.

Technological Advancements in Production

Technological advancements in the production of fermentation ingredients are significantly impacting the market dynamics in South Korea. Innovations in fermentation processes, such as the use of precision fermentation and bioreactor technologies, are enhancing the efficiency and scalability of ingredient production. These advancements not only improve yield but also reduce production costs, making fermentation ingredients more accessible to manufacturers. The fermentation ingredients market is expected to witness a surge in demand as companies adopt these technologies to meet the growing consumer preference for high-quality, sustainable products. Furthermore, the integration of automation and data analytics in fermentation processes may lead to improved product consistency and quality, further driving market growth.

Regulatory Support for Fermented Products

Regulatory support for fermented products in South Korea is playing a crucial role in shaping the fermentation ingredients market. The government has implemented policies that promote the production and consumption of fermented foods, recognizing their health benefits and cultural significance. Initiatives aimed at enhancing food safety and quality standards for fermentation ingredients are likely to bolster consumer confidence and stimulate market growth. Additionally, the establishment of guidelines for labeling and marketing fermented products may further encourage manufacturers to innovate and expand their product lines. As regulatory frameworks evolve, the fermentation ingredients market is expected to thrive, benefiting from increased consumer trust and a favorable business environment.