Government Initiatives and Funding

Government initiatives and funding aimed at improving healthcare infrastructure are vital for the embolic protection-devices market. In South Korea, the government has been actively investing in healthcare technologies to enhance patient care and outcomes. In 2025, it is anticipated that public funding for medical device research and development will increase by 20%, facilitating the introduction of innovative embolic protection devices. These initiatives not only support the development of new technologies but also promote awareness and training among healthcare professionals regarding the use of these devices. As a result, the market is likely to experience growth driven by both increased availability of advanced devices and improved healthcare practices, ultimately benefiting patients undergoing cardiovascular procedures.

Technological Innovations in Medical Devices

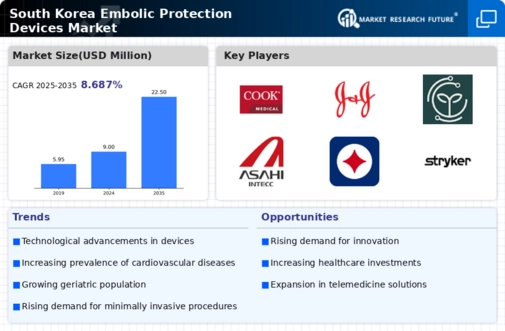

Technological innovations play a pivotal role in shaping the embolic protection-devices market. In South Korea, advancements in materials science and engineering have led to the development of more effective and safer embolic protection devices. For instance, the introduction of bioresorbable materials and improved delivery systems has enhanced the efficacy of these devices. The market is projected to grow at a CAGR of 8% from 2025 to 2030, driven by these innovations. Furthermore, the integration of digital technologies, such as real-time monitoring and data analytics, is expected to improve patient outcomes and streamline procedures. As healthcare providers increasingly adopt these advanced technologies, the demand for embolic protection devices is likely to rise, reflecting a shift towards more sophisticated medical solutions.

Increasing Awareness of Cardiovascular Health

The growing awareness of cardiovascular health among the South Korean population is a crucial driver for the embolic protection-devices market. As more individuals recognize the risks associated with cardiovascular diseases, there is a heightened demand for preventive measures, including embolic protection devices. Educational campaigns and health initiatives by the government and healthcare organizations have contributed to this awareness. In 2025, it is estimated that approximately 30% of the population actively seeks information on cardiovascular health, leading to increased consultations with healthcare professionals. This trend is likely to drive the adoption of embolic protection devices, as patients become more informed about their treatment options and the importance of preventing embolic events during procedures such as cardiac surgeries.

Rising Incidence of Stroke and Related Conditions

The rising incidence of stroke and related conditions in South Korea is a critical driver for the embolic protection-devices market. Stroke remains one of the leading causes of morbidity and mortality in the country, prompting healthcare providers to seek effective preventive measures. In 2025, it is estimated that stroke incidence will increase by 5% compared to previous years, leading to a greater emphasis on embolic protection during surgical interventions. This trend is likely to drive demand for devices that can mitigate the risk of embolic events, particularly in high-risk patients. As healthcare systems prioritize stroke prevention strategies, the embolic protection-devices market is expected to expand, reflecting a growing recognition of the need for effective solutions in managing cardiovascular health.

Aging Population and Increased Surgical Procedures

The aging population in South Korea is a significant driver for the embolic protection-devices market. As the demographic shifts towards an older age group, the incidence of cardiovascular diseases is expected to rise, leading to an increase in surgical procedures. By 2025, it is projected that over 15% of the population will be aged 65 and above, necessitating more interventions that require embolic protection. This demographic trend is likely to result in a higher demand for embolic protection devices during surgeries such as valve replacements and coronary interventions. Additionally, the healthcare system is adapting to accommodate this growing need, which may further stimulate market growth as hospitals invest in advanced medical technologies to ensure patient safety and improve surgical outcomes.