Rising Crime Rates

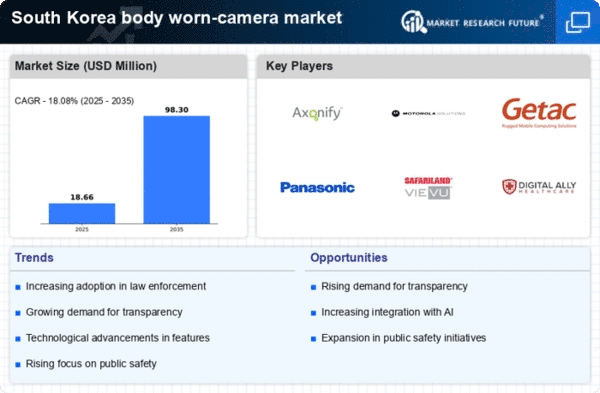

The rising crime rates in urban areas of South Korea are contributing to the growth of the body worn-camera market. As law enforcement agencies face challenges in managing public safety, the adoption of body worn cameras is seen as a strategic response to enhance surveillance and evidence collection. The market is projected to expand by 18% as agencies invest in these devices to deter criminal activity and improve incident documentation. This trend underscores the critical role that body worn cameras play in modern policing strategies, as they provide essential tools for law enforcement to address increasing security challenges.

Enhanced Security Concerns

The body worn-camera market is experiencing growth due to heightened security concerns across various sectors in South Korea. With increasing incidents of crime and public safety issues, law enforcement agencies are adopting body worn cameras to enhance accountability and transparency. The South Korean government has recognized the importance of these devices in improving public trust, leading to a projected market growth of approximately 15% annually. This trend indicates a shift towards proactive measures in crime prevention and evidence collection, thereby solidifying the role of body worn cameras in law enforcement operations.

Government Funding Initiatives

Government funding initiatives aimed at enhancing public safety are playing a crucial role in the body worn-camera market. In South Korea, various local and national programs are allocating budgets specifically for the procurement of body worn cameras for law enforcement agencies. This financial support not only facilitates the acquisition of advanced technology but also encourages the widespread adoption of these devices. The body worn-camera market is anticipated to benefit from these initiatives, with an expected increase in market size by 20% as agencies leverage government resources to improve their operational capabilities.

Public Demand for Transparency

There is a rising public demand for transparency in law enforcement practices, which is significantly influencing the body worn-camera market. Citizens in South Korea are increasingly advocating for the use of body worn cameras to ensure accountability among police officers. This societal pressure has led to various municipalities implementing policies that require the use of these devices during interactions with the public. As a result, the market is projected to grow by 12% over the next few years, as more agencies recognize the necessity of adopting body worn cameras to foster trust and transparency in their operations.

Integration with Smart Technologies

The integration of body worn cameras with smart technologies is driving innovation within the body worn-camera market. In South Korea, advancements in artificial intelligence and cloud computing are enabling real-time data analysis and storage solutions. This integration allows law enforcement agencies to access footage instantly, improving response times and operational efficiency. The market is expected to reach a valuation of $200 million by 2026, reflecting a growing reliance on technology to enhance policing methods. As agencies seek to modernize their operations, the demand for technologically advanced body worn cameras is likely to increase.