Growing Focus on Officer Safety

The body worn-camera market is increasingly shaped by a growing emphasis on officer safety and well-being. With rising concerns about violent encounters, law enforcement agencies are prioritizing tools that can provide evidence and support in critical situations. The presence of body worn cameras has been shown to reduce incidents of aggression towards officers, with studies indicating a decrease in use-of-force incidents by up to 30% in some UK police forces. This focus on safety not only protects officers but also enhances public trust in law enforcement. Consequently, the body worn-camera market is likely to see sustained growth as agencies continue to adopt these devices as essential safety equipment.

Legislative and Policy Developments

The body worn-camera market is influenced by ongoing legislative and policy developments aimed at regulating the use of surveillance technology. In the UK, recent discussions around data protection and privacy laws have prompted law enforcement agencies to adopt body worn cameras in a manner that aligns with legal requirements. This regulatory framework is crucial for ensuring that the deployment of body worn cameras is both effective and compliant with citizens' rights. As the body worn-camera market adapts to these evolving regulations, it is expected that compliance will drive further adoption, as agencies seek to mitigate legal risks while enhancing operational transparency.

Increasing Demand for Accountability

The body worn-camera market is experiencing a notable surge in demand for accountability within law enforcement and public service sectors. This trend is driven by heightened public scrutiny and the need for transparency in police operations. Recent data indicates that approximately 70% of UK police forces have adopted body worn cameras, reflecting a commitment to improving community relations and accountability. The implementation of these devices is seen as a proactive measure to enhance trust between the public and law enforcement agencies. Furthermore, the body worn-camera market is likely to benefit from ongoing discussions about the ethical implications of surveillance, as stakeholders seek to balance security needs with civil liberties.

Technological Integration and Innovation

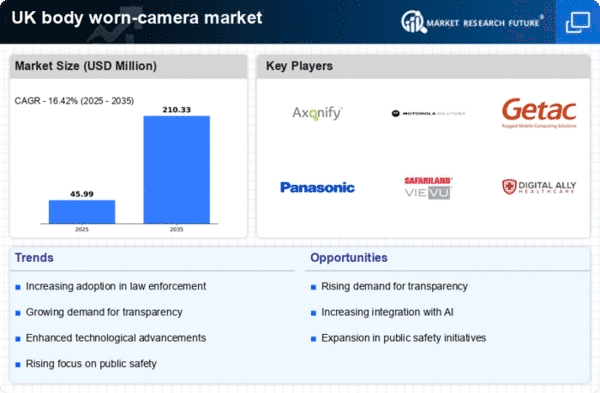

The body worn-camera market is significantly influenced by the integration of advanced technologies such as artificial intelligence (AI) and cloud computing. These innovations enhance the functionality of body worn cameras, enabling features like real-time data analysis and secure cloud storage. As of 2025, it is estimated that the market for AI-enabled body worn cameras in the UK could reach £150 million, driven by the demand for improved operational efficiency and data management. The body worn-camera market is thus positioned to evolve rapidly, as manufacturers invest in R&D to create smarter, more efficient devices that meet the needs of modern law enforcement.

Public Support for Surveillance Technology

The body worn-camera market is bolstered by increasing public support for surveillance technology as a means of enhancing safety and security. Surveys indicate that over 60% of the UK population supports the use of body worn cameras by police, viewing them as a tool for accountability and crime reduction. This public endorsement is pivotal for law enforcement agencies considering the implementation of body worn cameras, as it reflects a societal shift towards acceptance of surveillance measures. The body worn-camera market is thus likely to thrive, as agencies leverage this support to justify investments in technology that fosters community safety and trust.