Rising Surgical Procedures

The increasing number of surgical procedures in South Korea is a pivotal driver for the biosurgery market. As the population ages and the prevalence of chronic diseases rises, the demand for surgical interventions escalates. In 2025, it is estimated that surgical procedures will reach approximately 1.5 million annually, reflecting a growth of around 10% from previous years. This surge necessitates advanced surgical solutions, including biosurgical products that enhance healing and reduce complications. The biosurgery market is likely to benefit from this trend, as healthcare providers seek innovative solutions to improve patient outcomes and operational efficiency.

Increase in Sports Injuries

The rising incidence of sports-related injuries in South Korea is a significant factor influencing the biosurgery market. With a growing interest in sports and fitness, the number of injuries requiring surgical intervention is on the rise. In 2025, it is projected that sports injuries will account for approximately 20% of all surgical procedures. This trend creates a demand for biosurgical products that aid in faster recovery and improved healing. As athletes and active individuals seek effective treatment options, the biosurgery market is poised to expand, catering to the needs of this demographic.

Focus on Research and Development

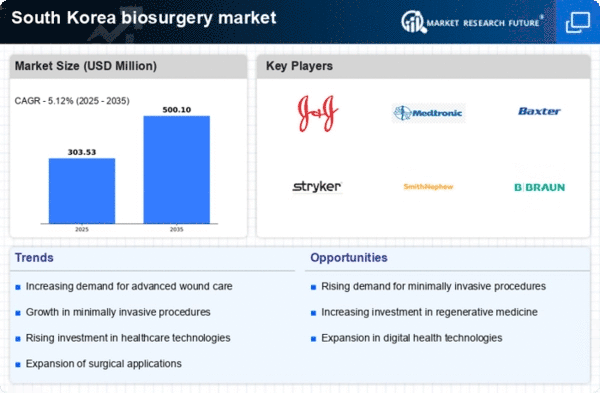

The emphasis on research and development (R&D) within the South Korean healthcare sector is a vital driver for the biosurgery market. With an increase in funding for medical research, particularly in the field of regenerative medicine and biosurgical innovations, the market is likely to see significant advancements. In 2025, R&D investments are expected to reach $500 million, fostering the development of new biosurgical products and techniques. This focus on innovation not only enhances the quality of care but also positions the biosurgery market for sustained growth as new solutions emerge to meet evolving healthcare needs.

Investment in Healthcare Infrastructure

The South Korean government is actively investing in healthcare infrastructure, which serves as a crucial driver for the biosurgery market. With an allocation of approximately $2 billion for healthcare improvements in 2025, the focus is on enhancing surgical facilities and integrating advanced technologies. This investment is likely to create a conducive environment for the adoption of biosurgical products, as hospitals and clinics upgrade their capabilities. Enhanced infrastructure not only supports the implementation of innovative biosurgery solutions but also improves patient access to these advanced treatments, thereby expanding the market.

Growing Awareness of Minimally Invasive Techniques

There is a notable shift towards minimally invasive surgical techniques in South Korea, which significantly influences the biosurgery market. Patients and healthcare professionals increasingly recognize the benefits of these techniques, such as reduced recovery times and lower risk of complications. This trend is supported by a 15% increase in the adoption of minimally invasive procedures over the past few years. As a result, biosurgical products that facilitate these techniques are gaining traction, leading to a more robust market. The demand for biosurgery solutions that align with this preference is expected to grow, further propelling the market forward.