Rising Surgical Procedures

The increasing number of surgical procedures in France is a primary driver for the biosurgery market. As healthcare providers adopt advanced surgical techniques, the demand for biosurgical products rises. In 2025, it is estimated that surgical procedures will reach approximately 15 million annually in France, reflecting a growth of around 5% from previous years. This surge is attributed to the growing prevalence of chronic diseases and the need for surgical interventions. Consequently, the biosurgery market is likely to experience significant growth as hospitals and surgical centers seek innovative solutions to enhance patient outcomes and reduce recovery times.

Supportive Regulatory Environment

The regulatory environment in France is becoming increasingly supportive of the biosurgery market. Regulatory bodies are streamlining approval processes for new biosurgical products, which encourages innovation and market entry. In recent years, the French government has implemented policies aimed at expediting the approval of medical devices and biosurgical products, reducing the time to market. This supportive framework is likely to foster competition and drive advancements in biosurgical technologies. As a result, the biosurgery market is expected to benefit from a wider array of products and solutions, ultimately enhancing patient care.

Investment in Healthcare Infrastructure

France's commitment to enhancing its healthcare infrastructure plays a crucial role in the biosurgery market. The government has allocated substantial funds, approximately €10 billion, to improve hospital facilities and surgical centers. This investment is expected to facilitate the adoption of advanced biosurgical technologies, thereby increasing the availability of innovative products. Enhanced infrastructure not only supports the implementation of biosurgical techniques but also encourages research and development in the field. As a result, the biosurgery market is poised for expansion, driven by improved access to cutting-edge surgical solutions.

Technological Innovations in Biosurgery

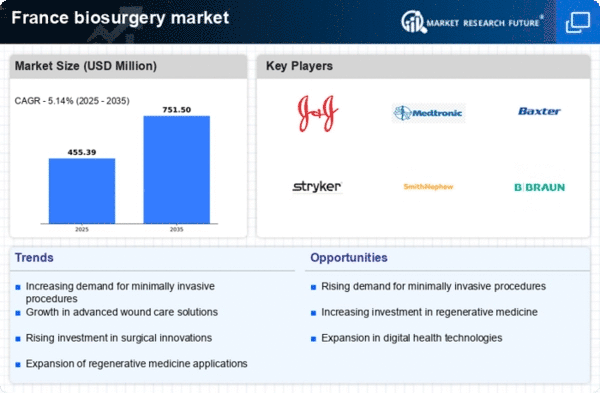

Technological innovations are transforming the biosurgery market in France. The introduction of advanced biomaterials and surgical adhesives has revolutionized surgical practices, leading to improved patient outcomes. In 2025, the market for biosurgical products is expected to reach approximately €1.5 billion, driven by these innovations. Companies are increasingly investing in research and development to create more effective and safer biosurgical solutions. This focus on innovation not only enhances the efficacy of surgical procedures but also expands the range of applications for biosurgical products, thereby stimulating market growth.

Growing Awareness of Minimally Invasive Techniques

There is a notable shift towards minimally invasive surgical techniques among healthcare professionals and patients in France. This trend is significantly influencing the biosurgery market, as these techniques often utilize biosurgical products to enhance surgical outcomes. The preference for minimally invasive procedures is driven by their associated benefits, including reduced recovery times and lower complication rates. In 2025, it is projected that minimally invasive surgeries will account for over 60% of all surgical procedures in France. This growing awareness is likely to propel the demand for biosurgical products, as they are integral to the success of these techniques.