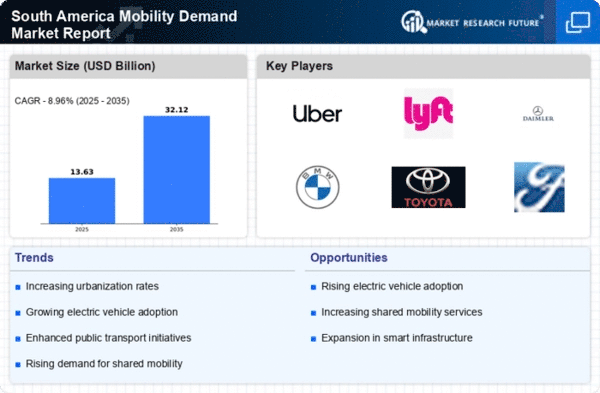

Urbanization and Population Growth

The rapid urbanization in South America is a crucial driver of the mobility demand market. As cities expand, the population density increases, leading to a heightened need for efficient transportation solutions. In 2025, urban areas in South America are projected to house over 80% of the population, which necessitates innovative mobility options. This trend indicates a shift towards public transportation systems, ride-sharing services, and micro-mobility solutions. The mobility demand market must adapt to these changes by enhancing infrastructure and services to accommodate the growing urban populace. Furthermore, the increasing number of vehicles on the road contributes to congestion, prompting a demand for alternative mobility solutions that can alleviate traffic and improve accessibility. Thus, urbanization and population growth are pivotal factors shaping the future of the mobility demand market in South America.

Government Initiatives and Policies

Government initiatives play a significant role in shaping the mobility demand market in South America. Various countries are implementing policies aimed at reducing carbon emissions and promoting sustainable transportation. For instance, Brazil has introduced incentives for electric vehicle adoption, which is expected to increase the share of electric vehicles in the market by 25% by 2027. Additionally, investments in public transportation infrastructure are on the rise, with governments allocating substantial budgets to enhance urban mobility. These initiatives not only aim to improve environmental sustainability but also seek to address the challenges of traffic congestion and urban sprawl. The mobility demand market is likely to benefit from these policies, as they create a more favorable environment for innovative transportation solutions. Consequently, government actions are a driving force behind the evolution of mobility services in South America.

Economic Growth and Rising Disposable Income

Economic growth in South America is a significant driver of the mobility demand market. As economies expand, disposable incomes are rising, leading to increased consumer spending on transportation options. In 2025, it is projected that the middle class in South America will grow by 15%, resulting in a higher demand for personal vehicles and mobility services. This trend suggests that consumers are more willing to invest in convenient and efficient transportation solutions. Additionally, the growth of e-commerce and delivery services is further fueling the demand for logistics and transportation solutions. The mobility demand market must adapt to these economic changes by offering diverse services that cater to the needs of a growing consumer base. Consequently, economic growth and rising disposable income are pivotal factors influencing the dynamics of the mobility demand market.

Technological Advancements in Transportation

Technological advancements are transforming the mobility demand market in South America. Innovations such as mobile applications for ride-hailing, real-time tracking systems, and autonomous vehicles are reshaping how people navigate urban environments. In 2025, it is estimated that the adoption of smart transportation technologies will increase by 30%, enhancing the efficiency and convenience of mobility services. The integration of data analytics and artificial intelligence into transportation systems allows for better traffic management and improved user experiences. As consumers increasingly seek seamless and efficient travel options, the mobility demand market must leverage these technologies to meet evolving expectations. Moreover, the rise of electric and hybrid vehicles, driven by technological progress, is likely to further influence consumer preferences and demand patterns in the market.

Environmental Awareness and Sustainability Trends

Environmental awareness is increasingly influencing the mobility demand market in South America. As concerns about climate change and pollution grow, consumers are becoming more conscious of their transportation choices. In 2025, surveys indicate that over 60% of consumers prioritize eco-friendly transportation options, which is likely to drive demand for electric vehicles and public transit solutions. This shift towards sustainability is prompting companies within the mobility demand market to innovate and offer greener alternatives. Furthermore, cities are implementing stricter regulations on emissions, encouraging the adoption of sustainable practices in transportation. The growing emphasis on environmental responsibility is reshaping consumer preferences and driving the demand for mobility solutions that align with sustainability goals. Thus, environmental awareness and sustainability trends are critical drivers shaping the future landscape of the mobility demand market.