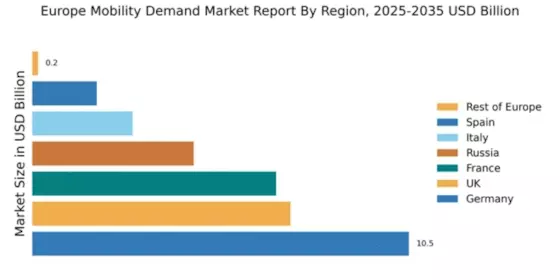

Germany : Strong Infrastructure and Innovation Drive Growth

Germany holds a commanding 10.5% market share in the European mobility demand sector, valued at approximately €12 billion. Key growth drivers include a robust automotive industry, government incentives for electric vehicles, and a strong push towards sustainable urban mobility. Demand trends show a shift towards shared mobility solutions, supported by regulatory policies promoting eco-friendly transport. Infrastructure investments in public transport and smart city initiatives further bolster market potential.

UK : Innovative Solutions and Regulatory Support

The UK boasts a 7.2% market share, valued at around €8 billion. Growth is driven by increasing urbanization, a rise in ride-sharing services, and government initiatives aimed at reducing carbon emissions. Demand for electric vehicles is surging, supported by favorable policies and incentives. The competitive landscape is characterized by a mix of traditional taxi services and innovative platforms like Uber and Lyft, which are reshaping consumer preferences.

France : Government Initiatives Fuel Market Growth

France captures a 6.8% market share, translating to approximately €7.5 billion. Key growth drivers include government policies promoting electric mobility and investments in public transport infrastructure. Demand trends indicate a growing preference for shared mobility services, particularly in urban areas like Paris and Lyon. The competitive landscape features major players such as Renault and international firms like Uber, enhancing service diversity and consumer choice.

Russia : Potential for Growth and Innovation

With a 4.5% market share valued at about €5 billion, Russia's mobility market is on the rise. Key growth drivers include urbanization, increasing disposable incomes, and a burgeoning tech sector. Demand for ride-hailing services is growing, particularly in major cities like Moscow and St. Petersburg. The competitive landscape includes local players and international firms, with a focus on adapting services to local consumer preferences and regulatory frameworks.

Italy : Cultural Factors Shape Market Dynamics

Italy holds a 2.8% market share, valued at approximately €3 billion. Growth is driven by a strong cultural affinity for personal vehicles and increasing interest in shared mobility solutions. Regulatory policies are evolving to support electric vehicle adoption, particularly in urban centers like Milan and Rome. The competitive landscape features both local and international players, with a focus on integrating traditional transport with innovative mobility solutions.

Spain : Urbanization Drives Market Expansion

Spain's mobility market accounts for 1.8% of the European share, valued at around €2 billion. Key growth drivers include rapid urbanization and a shift towards sustainable transport solutions. Demand for ride-sharing and electric vehicles is increasing, supported by government initiatives. Major cities like Madrid and Barcelona are pivotal markets, with a competitive landscape featuring both local startups and established international players.

Rest of Europe : Varied Demand and Growth Opportunities

The Rest of Europe holds a minimal 0.16% market share, valued at approximately €200 million. Growth drivers vary significantly across countries, influenced by local regulations and consumer preferences. Demand trends show a mix of traditional and innovative mobility solutions, with varying levels of infrastructure development. The competitive landscape is fragmented, with local players dominating in many regions, while international firms seek to expand their presence.