Evolving Legal Frameworks

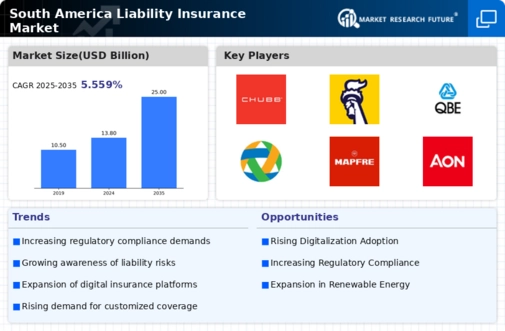

The legal frameworks governing liability in South America are evolving, with new regulations being introduced to address emerging risks. These changes are compelling businesses to reassess their insurance needs, leading to a greater demand for liability insurance. The liability insurance market is adapting to these regulatory shifts, which may include stricter compliance requirements and enhanced consumer protection laws. As businesses navigate this complex legal landscape, the need for comprehensive liability coverage becomes more pronounced, potentially driving market growth by an estimated 10% over the next few years.

Rising Awareness of Liability Risks

In South America, there is a growing awareness among businesses and individuals regarding the potential risks associated with liability claims. This heightened consciousness is likely driven by increased media coverage of legal disputes and their financial implications. As a result, more entities are seeking liability insurance to protect themselves from unforeseen liabilities. The liability insurance market is experiencing a surge in demand, with estimates suggesting a growth rate of approximately 8% annually. This trend indicates that businesses are prioritizing risk management strategies, thereby contributing to the expansion of the liability insurance market.

Economic Growth and Business Expansion

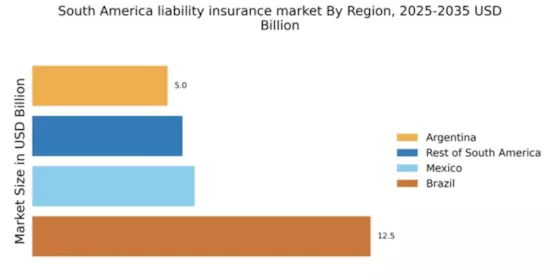

The economic landscape in South America is witnessing a phase of growth, with various sectors expanding their operations. This economic upturn is prompting businesses to invest in liability insurance as a safeguard against potential legal claims. The liability insurance market is benefiting from this trend, as companies recognize the importance of protecting their assets and ensuring compliance with legal standards. Reports indicate that the market could reach a valuation of $5 billion by 2027, reflecting the increasing reliance on liability insurance as a critical component of business strategy in the region.

Increased Consumer Protection Awareness

There is a notable rise in consumer protection awareness across South America, prompting businesses to adopt more robust liability insurance policies. As consumers become more informed about their rights, companies are recognizing the necessity of safeguarding themselves against potential claims. The liability insurance market is responding to this shift by offering more comprehensive coverage options that align with consumer expectations. This trend is likely to drive market growth, as businesses seek to enhance their reputations and mitigate risks associated with consumer litigation, potentially resulting in a market expansion of around 7% in the coming years.

Technological Advancements in Risk Assessment

Technological advancements are transforming the way risks are assessed in the liability insurance market. In South America, insurers are increasingly utilizing data analytics and artificial intelligence to evaluate potential liabilities more accurately. This shift not only enhances underwriting processes but also allows for more tailored insurance products. As a result, businesses are more inclined to invest in liability insurance, knowing that they are receiving coverage that is reflective of their specific risk profiles. The integration of technology in risk assessment could lead to a more competitive market, fostering innovation and potentially increasing market penetration.