Aging Population

The demographic shift towards an aging population in South America significantly influences the generic pharmaceuticals market. By 2025, it is estimated that over 15% of the population will be aged 65 and older, leading to an increased prevalence of chronic diseases. This demographic trend necessitates a higher demand for medications, particularly generics, which are often more affordable. The generic pharmaceuticals market is poised to capitalize on this growing need, as older adults typically require multiple medications for various health conditions. The affordability of generics allows for better adherence to treatment regimens, ultimately improving health outcomes. Additionally, the aging population may drive healthcare policies that favor the use of generics, further enhancing their market presence.

Cost Containment Strategies

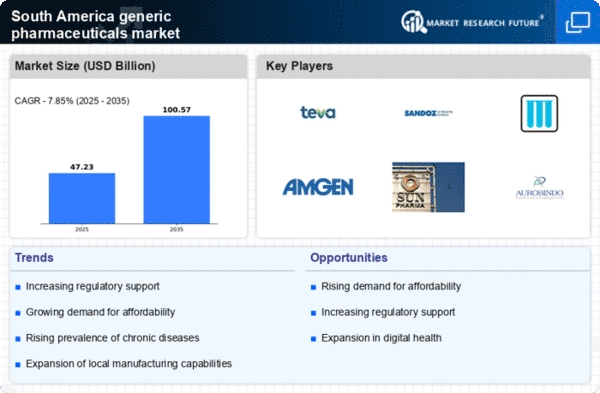

Cost containment strategies implemented by governments and healthcare systems in South America are driving the growth of the generic pharmaceuticals market. In an effort to manage rising healthcare costs, many countries are adopting policies that promote the use of generics. For instance, price negotiations and reimbursement policies favoring generics are becoming more common. By 2025, it is projected that generic drugs will account for over 50% of total pharmaceutical sales in the region. This shift not only benefits patients through lower out-of-pocket expenses but also alleviates the financial burden on healthcare systems. The generic pharmaceuticals market is thus positioned to thrive as these cost containment measures encourage the adoption of more affordable medication options.

Growing Healthcare Expenditure

The increasing healthcare expenditure in South America is a pivotal driver for the generic pharmaceuticals market. As governments and private sectors allocate more funds towards healthcare, the demand for affordable medications rises. In 2025, healthcare spending in the region is projected to reach approximately $1.5 trillion, with a substantial portion directed towards generic drugs. This trend indicates a shift towards cost-effective treatment options, as patients and healthcare providers seek to manage expenses. The generic pharmaceuticals market benefits from this growing expenditure, as it allows for greater accessibility to essential medications. Furthermore, the emphasis on preventive care and chronic disease management further fuels the demand for generics, as these medications often provide the same therapeutic benefits at a lower cost.

Rising Awareness of Generic Options

There is a notable increase in awareness regarding the benefits of generic medications among healthcare professionals and patients in South America. Educational campaigns and initiatives by health authorities have contributed to this trend, emphasizing the efficacy and safety of generics. As of 2025, surveys indicate that approximately 70% of patients are aware of generic alternatives, which positively impacts the generic pharmaceuticals market. This heightened awareness encourages patients to opt for generics, thereby reducing overall healthcare costs. Furthermore, healthcare providers are increasingly recommending generics as first-line treatment options, which further solidifies their position in the market. The growing acceptance of generics is likely to continue, fostering a more competitive landscape within the pharmaceutical sector.

Technological Advancements in Manufacturing

Technological advancements in manufacturing processes are playing a crucial role in shaping the generic pharmaceuticals market in South America. Innovations such as continuous manufacturing and advanced quality control systems are enhancing production efficiency and reducing costs. By 2025, it is anticipated that these technologies will enable manufacturers to produce generics at a lower price point while maintaining high quality. This is particularly important in a competitive market where price sensitivity is prevalent. The generic pharmaceuticals market stands to benefit from these advancements, as they not only improve profit margins but also facilitate faster entry of new generics into the market. As manufacturers adopt these technologies, the overall availability of affordable medications is likely to increase, further driving market growth.