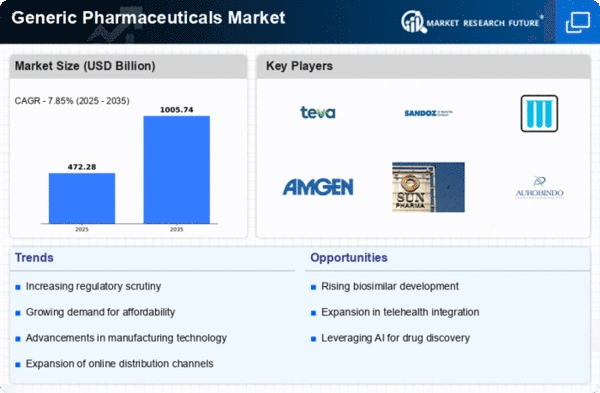

Market Growth Projections

The Global Generic Pharmaceuticals Market Industry is poised for substantial growth, with projections indicating a market size of 389.5 USD Billion in 2024 and an anticipated increase to 600 USD Billion by 2035. This growth trajectory suggests a robust demand for generic medications, driven by factors such as rising healthcare costs, patent expirations, and increased healthcare expenditure. The projected CAGR of 4.01% from 2025 to 2035 further underscores the potential for expansion within the industry. As the market evolves, it is likely to witness increased competition and innovation, ultimately benefiting consumers and healthcare systems worldwide.

Increasing Healthcare Expenditure

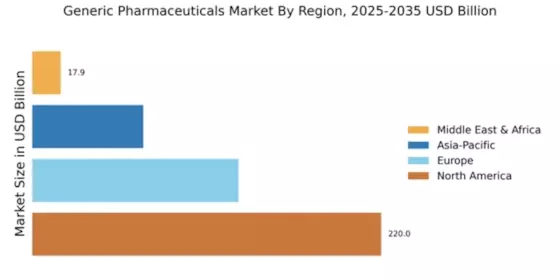

Growing healthcare expenditure globally is a pivotal factor influencing the Global Generic Pharmaceuticals Market Industry. As nations invest more in healthcare infrastructure and services, there is a corresponding rise in the consumption of pharmaceuticals, including generics. This trend is particularly pronounced in emerging markets, where governments are prioritizing healthcare access for their populations. The increase in healthcare budgets is likely to facilitate the adoption of generic medications, as they provide a cost-effective solution to rising healthcare costs. The projected CAGR of 4.01% from 2025 to 2035 indicates a sustained growth trajectory for the Global Generic Pharmaceuticals Market Industry, driven by increased healthcare spending.

Patent Expirations of Major Drugs

The expiration of patents for several blockbuster drugs plays a crucial role in driving the Global Generic Pharmaceuticals Market Industry. As patents expire, generic manufacturers can produce equivalent medications at lower prices, thereby increasing market competition. This phenomenon has been observed with numerous high-revenue drugs, leading to substantial cost savings for healthcare systems. For instance, the loss of exclusivity for drugs such as Lipitor and Plavix has allowed generics to capture significant market share. The anticipated growth trajectory, with the market expected to reach 600 USD Billion by 2035, underscores the impact of patent expirations on the Global Generic Pharmaceuticals Market Industry.

Regulatory Support for Generic Drugs

Regulatory frameworks that support the approval and marketing of generic drugs significantly bolster the Global Generic Pharmaceuticals Market Industry. Governments and regulatory bodies are increasingly recognizing the importance of generics in promoting competition and reducing healthcare costs. Initiatives aimed at streamlining the approval process for generics, such as the FDA's Generic Drug User Fee Amendments, have facilitated faster market entry for these products. This regulatory support not only enhances the availability of generics but also encourages innovation within the industry. As a result, the Global Generic Pharmaceuticals Market Industry is likely to benefit from a more favorable regulatory environment, contributing to its overall growth.

Rising Demand for Cost-Effective Medications

The Global Generic Pharmaceuticals Market Industry experiences a notable increase in demand for cost-effective medications. As healthcare costs continue to rise, patients and healthcare providers are increasingly turning to generic drugs as a more affordable alternative to branded medications. This trend is particularly evident in developing regions, where access to healthcare is often limited by financial constraints. The market is projected to reach 389.5 USD Billion in 2024, reflecting a growing acceptance of generics among consumers and healthcare systems alike. The shift towards generics is likely to contribute significantly to the overall growth of the Global Generic Pharmaceuticals Market Industry.

Technological Advancements in Drug Manufacturing

Technological advancements in drug manufacturing are transforming the Global Generic Pharmaceuticals Market Industry. Innovations in production processes, such as continuous manufacturing and advanced quality control techniques, are enhancing the efficiency and quality of generic drug production. These advancements enable manufacturers to reduce costs and improve product consistency, thereby increasing competitiveness in the market. Furthermore, the integration of digital technologies in supply chain management is streamlining operations and reducing lead times. As the industry adapts to these technological changes, it is poised for growth, with the market projected to reach 600 USD Billion by 2035, reflecting the positive impact of these advancements.