Remote Work Trends

The rise of remote work trends in South America is reshaping the enterprise software market. As organizations adapt to flexible work arrangements, there is a growing need for software solutions that support collaboration, communication, and project management. This shift has led to an increased investment in cloud-based software tools, which facilitate remote access and real-time collaboration among teams. Data indicates that the enterprise software market is experiencing a surge in demand for collaboration platforms, with an estimated growth rate of 15% in this segment alone. Companies are recognizing the importance of equipping their workforce with the necessary tools to maintain productivity and connectivity, thereby driving the overall growth of the enterprise software market.

Emerging Startups and Innovation

The emergence of startups and innovation hubs in South America is driving the enterprise software market. A vibrant ecosystem of tech startups is fostering creativity and competition, leading to the development of innovative software solutions tailored to local market needs. These startups are often agile and capable of quickly adapting to changing consumer demands, which positions them favorably within the enterprise software market. Data suggests that venture capital investment in South American tech startups has increased by 30% in the past year, indicating a growing interest in technology-driven solutions. As these startups continue to innovate, they are likely to contribute to the diversification and expansion of the enterprise software market, offering unique products and services that address specific challenges faced by businesses in the region.

Digital Transformation Initiatives

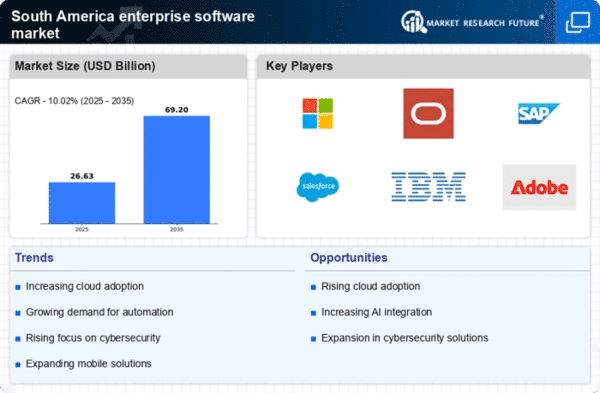

The ongoing digital transformation initiatives across various sectors in South America appear to be a primary driver for the enterprise software market. Organizations are increasingly investing in technology to enhance operational efficiency and customer engagement. According to recent data, the enterprise software market in South America is projected to grow at a CAGR of 12% from 2025 to 2030. This growth is largely attributed to the need for businesses to adapt to changing consumer behaviors and market dynamics. As companies embrace digital tools, the demand for software solutions that facilitate automation, data analytics, and customer relationship management is likely to rise. Consequently, this trend is expected to significantly impact the enterprise software market, fostering innovation and competition among software providers.

Regulatory Compliance Requirements

Regulatory compliance requirements in South America are increasingly influencing the enterprise software market. Governments are implementing stricter regulations across various industries, necessitating businesses to adopt software solutions that ensure compliance with local laws and standards. For instance, the financial sector is facing heightened scrutiny, leading to a surge in demand for compliance management software. This trend is reflected in the enterprise software market, where compliance-related software solutions are projected to account for approximately 20% of total software spending in the region by 2026. As organizations strive to mitigate risks associated with non-compliance, the demand for robust enterprise software solutions is expected to grow, driving market expansion.

Increased Investment in IT Infrastructure

Increased investment in IT infrastructure across South America is a significant driver of the enterprise software market. As businesses recognize the importance of robust IT systems, they are allocating more resources towards upgrading their technological capabilities. This trend is particularly evident in sectors such as manufacturing and retail, where companies are investing in software solutions that enhance supply chain management and operational efficiency. Recent reports suggest that IT spending in South America is expected to reach $100 billion by 2027, with a substantial portion directed towards enterprise software solutions. This influx of investment is likely to stimulate growth within the enterprise software market, as organizations seek to leverage technology for competitive advantage.