Growing Industrial Demand

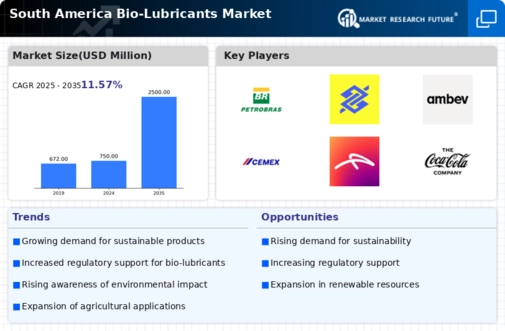

The industrial sector in South America is increasingly recognizing the benefits of bio lubricants, contributing to the growth of the bio lubricants market. Industries such as automotive, manufacturing, and construction are adopting bio-based lubricants due to their superior performance and lower environmental impact. The automotive sector, in particular, is projected to account for a significant share of the market, driven by the need for high-performance lubricants that comply with environmental standards. Reports suggest that the industrial demand for bio lubricants could lead to a market growth of approximately 12% annually, reflecting a shift towards sustainable practices within these sectors.

Rising Environmental Regulations

The bio lubricants market in South America is experiencing a notable surge due to increasing environmental regulations aimed at reducing pollution and promoting sustainability. Governments across the region are implementing stricter guidelines on the use of conventional lubricants, which often contain harmful chemicals. This regulatory landscape encourages industries to transition towards bio-based alternatives. For instance, Brazil has introduced policies that incentivize the use of eco-friendly products, which could potentially lead to a market growth of approximately 15% by 2027. As companies seek compliance with these regulations, the demand for bio lubricants is likely to rise, positioning the industry for substantial expansion.

Investment in Renewable Resources

Investment in renewable resources is a critical driver for the bio lubricants market in South America. As countries in the region strive to reduce their carbon footprint, there is a growing emphasis on sourcing raw materials from sustainable and renewable sources. This trend is supported by both government initiatives and private sector investments aimed at developing bio-based feedstocks for lubricant production. For instance, initiatives in Argentina and Brazil are focusing on the cultivation of oilseed crops specifically for bio lubricant applications. Such investments are expected to bolster the bio lubricants market, with forecasts suggesting a potential market growth of 18% by 2028.

Technological Advancements in Production

Innovations in the production processes of bio lubricants are significantly impacting the market in South America. Advances in biotechnology and chemical engineering have led to the development of more efficient and cost-effective methods for producing bio-based lubricants. These technological improvements not only enhance the performance of bio lubricants but also reduce production costs, making them more competitive against traditional lubricants. For example, the introduction of enzymatic processes has improved yield rates, potentially increasing market penetration. As a result, the bio lubricants market is poised for growth, with projections indicating a potential increase in market share of around 20% over the next five years.

Consumer Preference for Eco-Friendly Products

There is a discernible shift in consumer preferences towards eco-friendly products in South America, which is positively influencing the bio lubricants market. As awareness of environmental issues grows, consumers are increasingly seeking products that align with their values, including lubricants that are biodegradable and derived from renewable resources. This trend is particularly evident among younger consumers who prioritize sustainability in their purchasing decisions. Market analysis indicates that this consumer shift could result in a 10% increase in demand for bio lubricants over the next few years, thereby enhancing the overall market landscape and encouraging manufacturers to innovate further.