Rising Geriatric Population

The Global Somatostatin Analogs Market Industry is experiencing growth due to the rising geriatric population, which is more susceptible to hormonal disorders and related health issues. As the global population ages, the demand for effective treatment options, including somatostatin analogs, is expected to increase significantly. This demographic shift is particularly pronounced in developed countries, where healthcare systems are adapting to cater to the needs of older adults. Consequently, the market is likely to expand as healthcare providers seek to address the unique health challenges faced by this population. The increasing prevalence of age-related conditions further underscores the importance of somatostatin analogs in modern medicine.

Advancements in Drug Formulations

Innovations in drug formulations are propelling the Global Somatostatin Analogs Market Industry forward. Enhanced delivery mechanisms and improved pharmacokinetics are making somatostatin analogs more effective and patient-friendly. For example, the development of long-acting formulations allows for less frequent dosing, which is appealing to patients and healthcare providers alike. This trend is expected to contribute to the market's growth, with projections indicating a rise to 15.9 USD Billion by 2035. As pharmaceutical companies invest in research and development to create superior formulations, the market for somatostatin analogs is likely to benefit from increased adoption and patient compliance.

Rising Prevalence of Hormonal Disorders

The Global Somatostatin Analogs Market Industry is witnessing growth due to the increasing prevalence of hormonal disorders such as acromegaly and neuroendocrine tumors. These conditions necessitate effective treatment options, which somatostatin analogs provide. For instance, the market is projected to reach 7.45 USD Billion in 2024, reflecting a heightened demand for these therapeutic agents. As healthcare systems globally prioritize the management of such disorders, the adoption of somatostatin analogs is likely to rise, thereby driving market expansion. Furthermore, the increasing awareness among healthcare professionals about the efficacy of these drugs contributes to their growing utilization in clinical settings.

Increasing Research and Development Activities

The Global Somatostatin Analogs Market Industry is significantly driven by increasing research and development activities aimed at discovering new therapeutic applications for somatostatin analogs. Ongoing clinical trials and studies are exploring their potential in treating various conditions beyond hormonal disorders, such as certain types of cancers and gastrointestinal diseases. This expanding research landscape is likely to enhance the market's growth trajectory, as new indications could lead to broader usage of these drugs. The commitment to R&D in this field suggests a promising future for somatostatin analogs, potentially increasing their market share and relevance in the pharmaceutical industry.

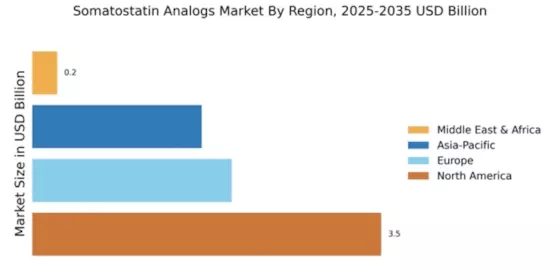

Growing Investment in Healthcare Infrastructure

The Global Somatostatin Analogs Market Industry is also influenced by the growing investment in healthcare infrastructure across various regions. Governments and private entities are increasingly allocating resources to enhance healthcare facilities, which facilitates better access to advanced treatment options, including somatostatin analogs. This trend is particularly evident in developing countries, where healthcare systems are evolving rapidly. As a result, the market is projected to experience a compound annual growth rate (CAGR) of 7.1% from 2025 to 2035. Improved healthcare infrastructure not only enhances the availability of these drugs but also promotes awareness and education regarding their benefits.